Advertisement|Remove ads.

Marathon’s Stock Surges On Record Q4 Revenue, Plans To Become The ‘Cisco Of Crypto’ – Retail Hopes Bitcoin Won’t Weigh It Down

Marathon Holdings Inc. (MARA) shares surged over 11% in morning trade on Thursday after the Bitcoin (BTC) miner reported record revenue and signaled a push into artificial intelligence (AI) infrastructure.

Retail interest surged, making the stock the third-highest trending ticker on Stocktwits at the time of writing.

The company posted fourth-quarter revenue of $214.4 million, surpassing Wall Street’s consensus estimate of $183.9 million by 16.5%.

Net income came in at $528.3 million, marking a 248% increase from the prior year, while adjusted (full form) EBITDA jumped 207% year-over-year to $794.4 million.

Marathon mined 2,492 Bitcoin in Q4, marking a 25% increase from the same period last year.

Under its new treasury policy to retain all mined Bitcoin, the company also acquired an additional 14,574 BTC, bringing its total holdings to 44,893 BTC by the end of 2024.

This cements its position as the second-largest corporate Bitcoin holder behind MicroStrategy, according to BitcoinTreasuries data.

The company also made significant strides in boosting its Bitcoin mining capacity. Its energized hash rate surged 115% year-over-year to 53.2 exahashes per second (EH/s), bolstered by a 300% increase in energy capacity and expansion into seven mining facilities.

Marathon also launched 25-megawatt micro data centers in Texas and North Dakota to reduce reliance on traditional power grids.

Looking ahead, Marathon sees AI as a major growth avenue. In its shareholder letter, the company likened its AI and high-performance computing role to Cisco’s infrastructure leadership during the internet boom.

"Whether for Bitcoin mining or AI inference, we believe our technologies will activate others to build while MARA provides the picks and shovels to deploy new systems and services, such as energy management, load balancing, and infrastructure,” the company said.

“While we’re taking proactive steps to differentiate, we believe our peers will have to scramble to adapt or be left behind,” it added.

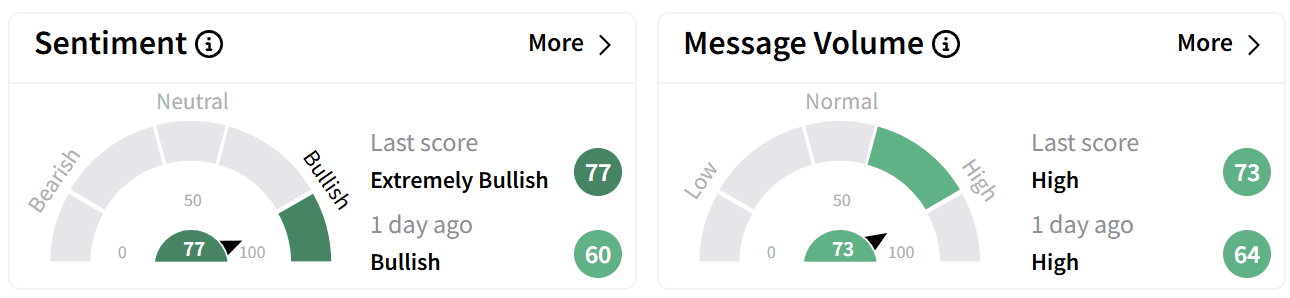

Retail sentiment on Stocktwits spiked to ‘extremely bullish’ from ‘bullish’ the previous day, with heightened retail chatter.

Some investors speculated that Marathon’s stock could rally even if Bitcoin’s price remained stable, while others expressed concerns that the cryptocurrency’s recent downturn could weigh on the stock.

Marathon shares have dropped 33% over the past month, mirroring Bitcoin’s increased volatility amid geopolitical tensions, former President Donald Trump’s tariff threats, and the record $1.46 billion Bybit hack.

Over the past year, MARA stock has lost 49%, even as Bitcoin has gained over 70%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1005541622_jpg_8079d8d434.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137832_jpg_1de3e68131.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bmnr_OG_jpg_83d4f3cc27.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_iran_jpg_753ef9f5af.webp)