Advertisement|Remove ads.

Marqeta Stock Tanks 40% On Lowered Revenue Outlook, But Retail Sentiment Defies Wall Street Doubts

Marqeta Inc. ($MQ) tanked nearly 40% as markets opened on Tuesday after the company slashed its revenue forecast for the fourth quarter.

The global card issuing platform now anticipates an increase of 10% to 12% next quarter, down from its previous forecast of 16% to 18%.

Marqeta cited “the heightened scrutiny of the banking environment and specific customer program changes” as reasons for the revision.

In addition to the forecast cut, Marqeta reported third-quarter earnings per share (EPS) of $0.06 on revenue of $128 million, falling short of Wall Street's expectations.

The stock faces a challenging outlook with over ten analysts reducing their price targets and six downgrading their recommendations on Tuesday before markets opened.

Deutsche Bank expressed concerns that heightened scrutiny is delaying new client onboarding, with some existing clients opting to take services in-house. It downgraded Marqeta to a ‘Hold’ rating from ‘Buy’ and cut its price target to $4 from $9.

JPMorgan echoed these concerns, lowering its price target to $5 from $6 while maintaining a ‘Neutral’ rating.

Meanwhile, Mizuho kept its ‘Outperform’ rating but reduced its target to $5 from $7, citing uncertainty for 2025 due to the lowered outlook.

Morgan Stanley also adjusted its target to $5 from $7, labeling Marqeta as “likely to remain a show-me story” for 2025 due to recent execution challenges.

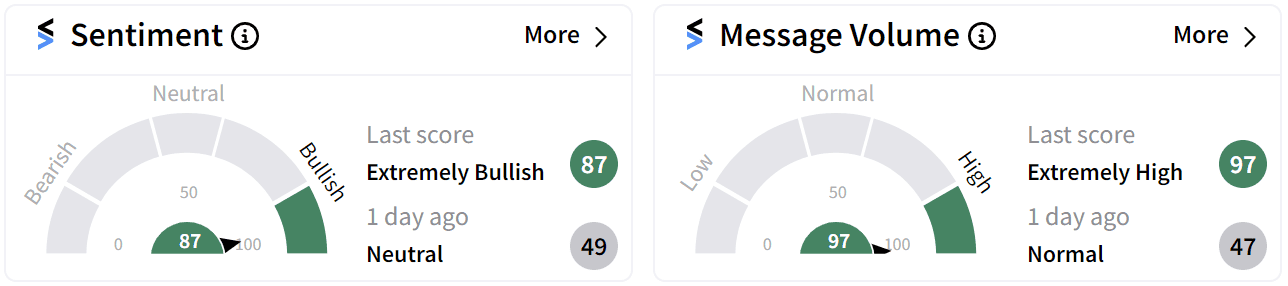

Despite the disappointing outlook and analyst downgrades, retail sentiment on Stocktwits was surprisingly ‘extremely bullish’ (87/100) at the market's opening, buoyed by ‘extremely high’ chatter (97/100).

Many users on the platform believe that the sharp decline in share price is unwarranted.

Wells Fargo analyst Andrew Bauch noted that Marqeta's credibility may take longer to restore than initially expected and emphasized uncertainty regarding whether the fundamentals have been entirely derisked.

Marqeta’s stock has lost 46% of its value so far in 2024.

For updates and corrections email newsroom@stocktwits.com.

Read more: Hims & Hers Soars Pre-Market After Analysts Boost Price Targets On Strong Q3 Performance

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Service_Now_logo_jpg_c0da5348e8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_jpg_dcfe443bb4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_doordash_jpg_6a0ffd4b33.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_eric_trump_OG_jpg_19bc149869.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_opendoor_OG_jpg_55300f4def.webp)