Advertisement|Remove ads.

Mastercard Stock Climbs After-Hours As Wall Street Awaits Earnings: Tariff Impact, Cross-Border Trends In Spotlight

Mastercard (MA) stock was up marginally in extended trading on Wednesday ahead of the company’s earnings the next day.

Wall Street expects the payments firm to post earnings of $3.55 per share on revenue of $7.12 billion, according to FinChat data. Mastercard has topped quarterly profit estimates in all four previous quarters.

The Purchase, New York-based firm’s earnings would be closely watched by investors amid an uncertain macroeconomic outlook.

Its peers, American Express and Visa, have both topped analysts’ expectations of quarterly profit in April.

While some firms have opted to withdraw their full-year forecasts amid unpredictable policy changes, the payments firms have shown signs of resilience.

American Express reiterated its profit and revenue forecasts for 2025, while Visa opted to raise its net revenue growth forecast after a strong first quarter.

Wall Street analysts would also pay close attention to the firm’s cross-border payments volumes, especially between the U.S. and Canada.

Visa said earlier this week that there had been a significant decline in transactions between Canada and the United States following President Donald Trump’s tariffs on some Canadian goods, as well as his public comments on making Canada the 51st state.

Investors would also be keen to hear about Mastercard’s commentary on whether customers moved up their purchases to avoid Trump’s tariffs.

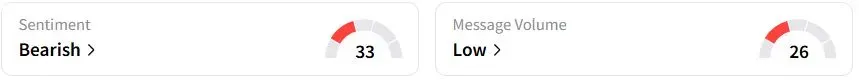

Retail sentiment on Stocktwits was in the ‘bearish’ (33/100) territory, while retail chatter was ‘low.’

The stock has a forward price-to-earnings ratio of 34, compared with 29.4 for Visa and 17.2 for American Express. The P/E ratio is used to assess a company's valuation.

Mastercard stock has risen 3.6% year to date compared with a 5.1% fall in the S&P 500 index.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_iran_jpg_753ef9f5af.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259503553_jpg_13fb8f2e88.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2220967996_jpg_b5dd23b15f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2248586785_jpg_9c6ef18a07.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)