Advertisement|Remove ads.

Mattel Shares Fall Premarket After Q3 Miss, CEO Says US Sales Improving: Retail Very Bullish

- Mattel’s shares fall nearly 6% in premarket trading following Q3 results, which missed expectations.

- Mettel saw acute weakness in its North American business, but the company said U.S. sales are improving in Q4.

- Retail sentiment for MAT stock climbs to ‘extremely bullish.’

Mattel, Inc.’s shares declined 5.7% in early premarket trading on Wednesday after its quarterly results missed analyst expectations.

The maker of Barbie dolls and Hot Wheels toy cars said net sales declined 6% year-over-year (YoY) to $1.74 billion in the third quarter, missing the FactSet estimate of $1.83 billion. The company's core markets showed weakness, with North America sales falling 12%, while international sales climbed 3%.

Adjusted EPS declined to $0.89 from $1.14, also missing the estimate of $1.06.

Mattel’s results are the latest sign of how the U.S. trade tariffs are affecting toy makers, which heavily rely on manufacturing in China and Asian countries.

In May, Mattel suspended its annual financial guidance and said it would increase prices for some products in the U.S. to counter higher costs from the tariffs. Until February, Mattel manufactured about 40% of its products in China, with significant manufacturing also in Mexico, Indonesia, and Malaysia.

The company reissued its full-year guidance on Tuesday. It expects net sales to increase between 1% and 3% and its EPS to be between $1.54 and $1.66.

Meanwhile, the management noted an uptick in the U.S. business. “While our U.S. business was challenged in the third quarter by industry-wide shifts in retailer ordering patterns, the fundamentals of our business are strong,” CEO Ynon Kreiz said in a statement.

“Since the beginning of the fourth quarter, orders from retailers in the US have accelerated significantly.”

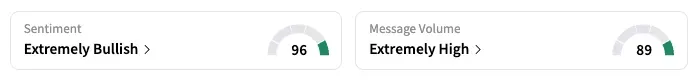

On Stocktwits, the retail sentiment for MAT shifted to ‘extremely bullish’ as of early Wednesday, from ‘bullish’ the previous day. Notably, this comes after a sharp rise in the stock, which has risen nearly 12% this month.

Year-to-date, Mattel shares are up 6.2%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Vanda_jpg_943c16fa4f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2222341271_jpg_26b9066cf6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2249860620_jpg_2bd9e54f08.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222819201_jpg_edcbb1336e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sarepta_Therapeutics_jpg_6cce13dbca.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_conocophillips_resized_98da51d9b9.jpg)