Advertisement|Remove ads.

Will Meta Stock’s Dream 19-Session Run Snap? Retail Bearish Even As Social Media Giant Hikes Dividend

Meta Plaforms, Inc. (META) stock has been on a 19-session winning streak and it is among the best-performing S&P 500 companies for the year-to-date (YTD) period.

Following another strong quarterly performance, the Mark Zuckerberg-led social media giant announced a 5% increase in its quarterly cash dividend. The $0.525-per-share first-quarter dividend applies to both Class A and Class B shares, and it is payable on March 26, to shareholders of record as of March 14.

The Menlo Park, California-based company initiated dividend payment a year back when its board approved a quarterly cash dividend of $0.50. Since then, it has made four payouts of $0.50 per share each.

The recent financial statements show 2.6 million in diluted outstanding shares and the dividend payment will likely cost the company $1.37 million.

Meta reported in late January better-than-expected fourth-quarter results but lukewarm first-quarter guidance amid its capital expenditure ramp-up created some nervousness among investors.

The company is part of the Magnificent Seven group of big techs that fueled the bull market rally seen since October 2022. The recovery in advertising spending, efficiency focus and in its artificial intelligence (AI) initiatives helped improve fundamentals.

Meta stock generated an above-market return of 66% in 2024.

As recently as this week, Meta began another round of job cuts impacting 5% of its worldwide workforce, which it called “performance terminations.”

Meta stock received a Street-high price target of $935 from Tigress Financial’s Ivan Feinseth this week. The analyst is positive about Meta’s initiatives helping drive increased user engagement, better content and a more effective advertising experience.

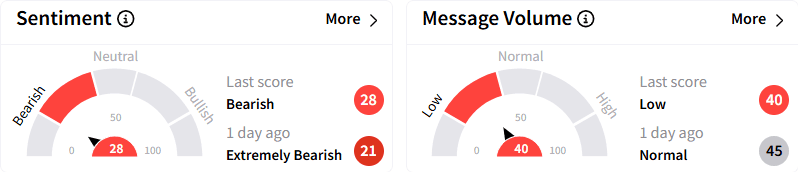

On Stocktwits, sentiment toward Meta stock remained lackluster, although improving to ‘bearish’ (28/100) from ‘extremely bearish’ a day ago. The message volume have dropped off to ‘low’ levels.

The muted sentiment of retailers stemmed from valuation concerns and TikTok’s return to the U.S. on Apple Store and Google Play Store. The Chinese short video-sharing app’s management voluntarily took it off on Jan. 18 when a U.S. ban came into effect.

Meta closed Thursday’s session up 0.44% at $728.56, gaining over 24% YTD.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Yelp Stock Rises As Investors Cheer Q4 Beat, Positive Guidance: Retail’s Unimpressed

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2228900989_jpg_e94daec744.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_Red_OG_jpg_d64521f99a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2238161001_jpg_d763653491.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2202902434_jpg_34a840ada1.webp)