Advertisement|Remove ads.

MP Materials’ CEO Urges Caution Over Rare Earth Projects, Flags Supply Chain Challenges

- CEO James Litinsky urges Washington to continue leveraging loans, grants, and incentives to attract private investment.

- The U.S. government has acquired stakes in companies such as MP Materials, Lithium Americas, Critical Metals, and Trilogy Metals.

- On Thursday, the U.S. government added copper, silver, and uranium, among others, to its list of critical minerals, in a bid to shore up domestic production.

MP Materials’ (MP) CEO James Litinsky has urged investors to be cautious about rare earth projects, warning that the industry’s economics remain challenging despite growing government support.

Litinsky told investors on the company’s third-quarter earnings call that “the vast majority of projects being promoted today simply will not work at virtually any price,” emphasizing the structural hurdles facing the sector, according to Koyfin’s transcript.

Shares of rare earth companies have been volatile in recent months amid speculation that the Trump administration may replicate its landmark deal with MP.

In July, MP Materials reached an agreement for a public-private partnership with the United States Department of Defense (renamed as the Department of War), which includes a multibillion-dollar package of investments and long-term commitments from the Pentagon.

The deal also included an equity stake by the Pentagon and a price floor for MP’s products, in a bid to reduce China’s dominance in the rare earth supply chain.

The U.S. government has also taken stakes in companies such as Lithium Americas, Critical Metals, and Trilogy Metals.

Supply Chain Challenges

Describing the sector as a “structural oligopoly,” Litinsky argued that flooding the market with numerous new projects wouldn’t guarantee a stable supply chain. Instead, he called on Washington to continue leveraging loans, grants, and incentives to attract private investment.

“I do think that there’s room for a lot of other players and a lot of other supply, but I think that the point is that to get to that 5 or 10 years, you’re going to need materially higher prices. So the sort of the MP deal, if you will, I just don’t think that’s enough,” he added.

Domestic Drive

Rare earth elements have been the key factor in the ongoing “tariff war” between the U.S. and China, with the latter controlling roughly 70% of global rare earth mining and nearly 90% of processing capacity.

In an effort to shore up domestic production and reduce reliance on Chinese imports, the U.S. government added copper, silver, and uranium, among others, to its list of critical minerals, according to an official statement on Thursday.

Critical minerals, including lithium, nickel, cobalt, manganese, graphite, and rare earth elements, are essential to modern technologies and defense systems, ranging from batteries and wind turbines to electric vehicle motors and power grids.

Q3 Results

MP Materials’ revenue for the fiscal year 2025 third-quarter fell 15% year-on-year to $53.55 million, compared to the Fiscal.ai-compiled consensus of $53 million. The quarterly adjusted loss per share narrowed to $0.10 from $0.12, while analysts, on average, had expected a loss of $0.16 per share.

Stock Movement

MP Materials’ shares were up 5.2% on Friday, despite falling around 7% in premarket.

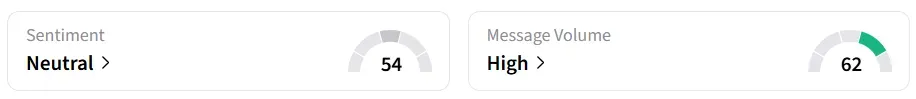

Retail sentiment around the stock turned ‘neutral’ from ‘bearish’ a session earlier, amid ‘high’ message volumes, according to Stocktwits data.

Users seemed confident about betting on further upside.

Year-to-date, the stock has surged 247%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_opendoor_OG_jpg_55300f4def.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_federal_reserve_jpg_7298dc8578.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_generic_resized_jpg_3444b70edf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_snap_resized_jpg_9672f61595.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)