Advertisement|Remove ads.

Netflix Q4 Earnings: Three Things Investors Are Watching

- Analysts expect Netflix’s Q4 revenue to rise nearly 17%, in line with recent trends and its own forecast.

- NFLX has dropped 35% from its mid-2025 peak, with sharp declines recently as the WBD deal drags on.

- Brokerages have recently lowered their price targets but are broadly upbeat on the company.

Netflix, Inc. is expected to report largely in-line fourth-quarter results on Tuesday, with the stock at a notably attractive level after a 35% slide from its June peak, even as the streamer moves ahead with its massive acquisition of most of Warner Bros. Discovery.

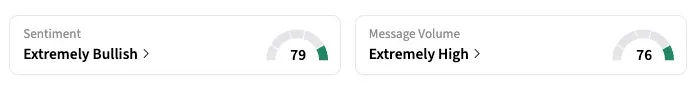

The streamer’s shares gained 0.2% in early premarket; they have declined in each of the last three sessions. On Stocktwits, retail sentiment for NFLX held in the ‘extremely bullish’ zone, unchanged from the previous day.

Elephant In The Room, Not

Analysts and investors are primarily looking for updates on its acquisition of WBD’s studio and streaming assets. The $82.7 billion deal, largely funded by debt, was announced on Dec. 5.

While Netflix is expected to give few material updates, any colour would be welcome, especially given that Paramount Skydance, the other WBD bidder, is going all in to challenge the deal.

As the deal moves along, the decline in Netflix’s stock has made investors uncomfortable. Last week, KeyBanc cut its price target on the stock to $110 from $139, while keeping its ‘Buy’ rating, mainly due to the recent stock slide and tough comparisons with the 2025 content slate.

Earlier, Wedbush cut its target to $115 from $140, while keeping its ‘Outperform’ rating on shares. The brokerage gave a positive view, saying that it has several levers to deliver substantial growth over the coming years.

Revenue Momentum

Analysts expect Netflix’s quarterly revenue to rise 16.8% to $11.97 billion – a pace of growth consistent with the last few quarters and in line with Netflix’s forecast – and adjusted net profit to rise 29% to $0.55 per share, according to Koyfin.

They expect Netflix to forecast first-quarter revenue growth of 15.5%, reaching $12.17 billion.

Analysts highlighted live events as a meaningful driver, a trend underscored by Netflix’s record-breaking Lions–Vikings Christmas Day game and its recent expansion of U.S. WWE rights to include the archival library.

Subscriber Base Health

Although Netflix stopped sharing subscriber figures a year ago, Reuters reported on Visible Alpha estimates that net subscriber additions could be around 10 million, with the streamer ending the year with more than 327 million users.

Netflix could give some colour on the subscriber health, which directly ties to the company’s advertising income.

Currently, 30 of the 45 brokerages have a ‘Buy’ or higher rating on the stock, with a $122.96 average price target, implying a 40% stock upside.

Netflix will report its results after the market-close.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Trump Posts AI Images Of Greenland Takeover, Claims NATO Chief Rutte Has Pledged 'Way Forward'

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2202237165_jpg_188d67bdb5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_iran_2_jpg_0c6789db95.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263736058_jpg_2b8f901978.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2244298120_jpg_ceb8c90666.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_iran_jpg_753ef9f5af.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1813801150_jpg_9e452258fa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)