Advertisement|Remove ads.

New Fortress Stock Collapse Triggers 1,000% Surge In Retail Chatter

New Fortress (NFE) stock saw a heavy surge in retail chatter on Monday after the company slumped nearly 43% to hit an all-time low.

According to Koyfin data, about 67.7 million shares changed hands, the second-highest trading volume in the company’s history. The stock has a short interest of 16.7%.

On Friday, after the market closed, the LNG firm said its second-quarter net loss ballooned to $557 million, compared with $86.9 million in the year-ago quarter. It booked significant non-cash impairments totalling $699 million, which was slightly offset by gains from its Jamaica asset sale.

The company has a long-term debt of $7.8 billion as of June 30, and an unrestricted cash balance of $551 million.

The company reiterated its going concern doubts in a regulatory filing, also noting its exploration of strategic alternatives, including asset sales, to enhance its capital structure. It has retained Houlihan Lokey Capital, Inc. as financial advisor and Skadden, Arps, Slate, Meagher & Flom LLP as legal advisor to assist them in raising capital.

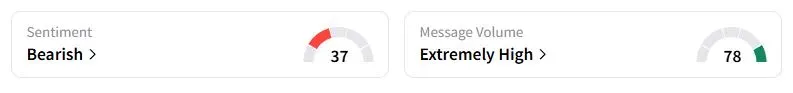

Retail sentiment on Stocktwits about New Fortress was in the ‘bearish’ territory at the time of writing, while retail message volume surged over 1,000%.

According to TheFly, Capital One downgraded the stock to ‘Underweight’ from ‘Equal Weight’ and set a price target of $1.

The primary reason behind the recent turmoil is the company’s inability to secure long-term LNG agreements for its Latin American power-generation assets. This is due to its non-investment-grade credit rating, which forces it to buy LNG at a higher price.

The company said it continues to negotiate a long-term gas sale agreement with Puerto Rico’s PREPA to provide gas to the island’s residents. It also expects an earnings boost after its Brazil, Nicaragua, and Puerto Rico expansions come online.

“The PR (Puerto Rico) contract is still the crux of the issue at this point, and there is a reasonable chance something positive comes out of that for a nice bump,” one user said.

New Fortress stock has fallen 90% this year.

Also See: Australia’s Sovereign Wealth Fund Cuts US Exposure Citing Trump’s Policies

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1236894865_jpg_fc1259ad29.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194622714_jpg_c18475d557.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2215332175_jpg_11a3fe7b09.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_capricor_jpg_9f4f8ab098.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_cryptocurrency_generic_jpg_4184e1dbd8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)