Advertisement|Remove ads.

India Market Wrap: Nifty, Sensex Snap 7-Day Gains, FMCG Stocks Drag

Indian markets took a breather on Thursday after a seven-session rally, closing in the red amid expiry-day volatility and selling pressure in FMCG counters.

The Nifty 50 ended below the psychological mark of 24,300, while the Sensex slipped beneath 80,000, both closing near the day’s low.

The broader market showed more resilience, with the Nifty Midcap 100 managing to close at 54,969, outperforming the benchmarks.

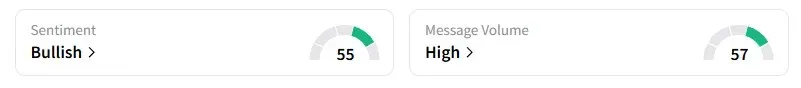

On Stocktwits, retail sentiment surrounding the Nifty 50 stayed ‘bullish,’ despite the dip.

FMCG stocks were the key laggards after disappointing earnings from HUL, Nestle India, and Tata Consumer Products dampened investor mood.

HUL dropped 4% as the management cited margin pressures ahead.

Syngene was another major loser, tumbling over 13% as management commentary spooked investors. CFO Deepak Jain indicated that earnings before interest, tax, depreciation, and amortization (EBITDA) margins might moderate to the mid-twenties for fiscal year 2026 (FY26), with a potential year-on-year decline in net profit.

On the positive side, pharma and metal stocks bucked the trend, finishing in the green.

IndusInd Bank continued to build on its recent gains, rising 3% after providing clarity on its MFI portfolio.

Globally, sentiment remained subdued. European markets were trading lower, while Dow Futures pointed to a weak start on Wall Street.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1813801150_jpg_9e452258fa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2190302521_jpg_796f64970e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194612888_1_jpg_5f7b7f6186.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1384896168_jpg_87fab3f04d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263571605_jpg_f769289486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)