Advertisement|Remove ads.

Nifty Holds 25,000 Even As Ceasefire Jitters Cap Upside; Adani Stocks, OMCs, PSU Banks Rally

Indian equity markets ended off the day’s high on Tuesday, with the Nifty ending above the psychological 25,000 mark.

Benchmarks began the day on a strong note after US President Donald Trump announced a ceasefire between Iran and Israel, pushing the Nifty to its highest intraday levels of 25,300 this year. However, reports of a ceasefire breach, which Iran later denied, led to a sell-off in the afternoon session.

The monthly expiry session also weighed on investor sentiment. The Sensex ended 158 points higher to close at 82,055, while the Nifty 50 rose 103 points to finish at 25,075.

Broader markets outperformed, with the Nifty Midcap and Smallcap indices rising 0.7%. Sectorally, barring media and oil & gas, rest of the indices ended in the green, led by heavy buying in PSU banks and metals.

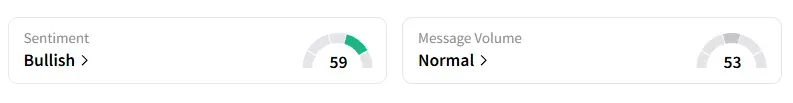

The retail investor sentiment surrounding the Nifty 50 turned ‘bullish’ earlier on Stocktwits.

Adani Ports ended as the top Nifty gainer, closing nearly 3% higher. Adani Enterprises too gained over 1% after chairman Gautam Adani, in the AGM, projected a capital expenditure of $15–$20 billion annually over the next five years.

Crude oil prices easing below the $70/barrel mark sparked a rally across oil marketing companies, with HPCL, BPCL and IOC gaining between 2% to 3%. On the flip side, upstream oil companies like ONGC (-3%), Oil India (-5%) ended lower.

Oil-sensitive sectors, such as paints and aviation, also saw significant moves. Kansai Nerolac rose 2%, while Interglobe Aviation ended 3% higher.

Bajaj Consumer shares rallied 20%, driven by a leadership transition. The company has appointed Naveen Pandey as its new managing director.

Enviro Infra shares surged 10% after it received new orders worth ₹306 crore.

Vodafone Idea surged 5% on news reports that the government was mulling fresh relief measures. And Astec Lifesciences ended 7% higher after its board approved a rights issue worth 250 crore.

Swan Energy saw strong volumes, ending 4% higher. The company has formed a Special Purpose Vehicle (SPV) to tap into high-growth segments including defense, aerospace, and railways.

KPIT Technologies’ shares ended 6% lower following a mid-quarter update that flagged delays in deal closures, particularly in the US and Asia.

Defense stocks witnessed profit booking: GRSE fell 9%, BEML fell 7%, while BDL, Paras Defence and Astra Microsystems ended 5% lower.

SEBI-registered analyst Akhilesh Jat noted that the Nifty formed a bearish reversal candle with a long upper wick, indicating significant intraday selling pressure. He sees resistance at 25,335 and support at 24,730 for the index. Jat expects volatility to remain elevated and advised traders to exercise caution as the market remains highly sensitive to global geopolitical cues, especially from the Middle East.

Globally, European markets traded higher, and Dow Futures indicated a strong opening for Wall Street.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2226079120_jpg_10ed2924af.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_oct23_jpg_588046d0a9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2239867148_jpg_8df22810c1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227347123_jpg_b7a8c29717.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1236199359_jpg_28b0018e3a.webp)