Advertisement|Remove ads.

Novavax Wins FDA Approval For COVID-19 Vaccine: Retail Calls For Buyback And Bigger Moves

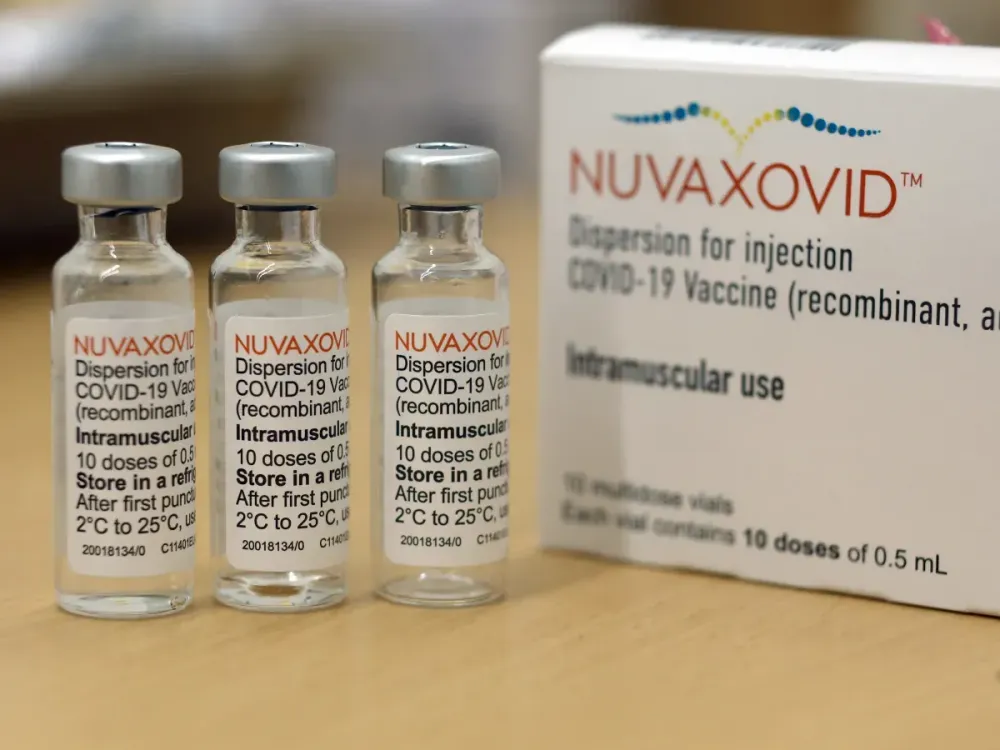

Novavax Inc. drew retail attention on Friday after receiving a Biologics License Application for its COVID-19 vaccine, Nuvaxovid, from the U.S. Food and Drug Administration.

Novavax shares closed at $6.73 after a 7% rise on Friday but fell 2.5% to $6.56 during after-hours trading.

The license allows Novavax to manufacture and distribute its COVID-19 vaccine with an adjuvant for active immunization in adults 65 or older and individuals between 12 and 64 with specific health conditions that increase their severe COVID-19 risks.

Under the NUVAXOVID brand, Novavax can sell its product in single-dose (0.5 mL) pre-filled syringes since regulatory approval confirmed manufacturing at specified sites.

This vaccine contains recombinant full-length SARS-CoV-2 spike glycoprotein together with Matrix-M adjuvant in its formulation.

The FDA said that the application needed no advisory committee referral due to a problem-free review.

Under storage conditions of 2°C to 8°C, the vaccine remains stable for three months, while the agency demands strict adverse event reporting for myocarditis, pericarditis, atrial fibrillation, and cranial nerve disorders.

The postmarketing requirements mandate multiple pediatric studies to be completed between 2025 and 2031, while safety research on myocarditis and pericarditis will extend throughout the next decade.

The FDA approval date exceeded its original April 1 deadline.

Robert F. Kennedy Jr., the U.S. Health and Human Services Secretary, pointed to composition concerns to explain the vaccine delay.

The Novavax vaccine uses traditional protein-based technology, while Moderna and Pfizer vaccines use mRNA technology. Manufacturing and regulatory obstacles prevented Novavax from exploiting the early COVID-19 vaccine market boom.

On stocktwits, retail sentiment was ‘extremely bullish’ amid ‘high’ message volume.

Some retail traders suggested that a share buyback would be a logical next step for Novavax, pointing to the stock’s currently low valuation.

Others encouraged fellow holders to stay committed, with optimistic sentiment targeting a potential rise toward the $200 level.

The stock has declined 21.5% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254648547_jpg_a843db78b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1000648682_jpg_6aa61e3574.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259602028_jpg_5b1a490e64.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259775985_jpg_a06a1e88c3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_dogecoin_OG_2_jpg_304df31f25.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_vitalik_buterin_OG_jpg_7ac8ea93fe.webp)