Advertisement|Remove ads.

Novo Nordisk Stock Tumbles: HSBC Downgrades After ‘Lottery Ticket’ Alzheimer’s Bet Fails, But Retail Traders Call Selloff ‘Ridiculous’

- HSBC cut Novo Nordisk to ‘Hold’ after its EVOKE Alzheimer’s trials showed no slowing of disease progression versus placebo.

- JPMorgan called the sharp market reaction an “overreaction,” noting little impact on its forecasts.

- Stocktwits traders slammed the selloff, arguing expectations for semaglutide in Alzheimer’s were already low.

Novo Nordisk shares logged their sharpest decline in nearly four months on Monday after its late-stage Alzheimer’s studies for oral semaglutide failed to show superiority over placebo, leading HSBC to downgrade the company and warn that growth drivers may now be harder to sustain.

The stock closed down 5.6% at $44.97 on Monday, before ticking up 1% in after-hours trading.

HSBC Cuts Rating After EVOKE Trials Fall Short

HSBC downgraded Novo Nordisk to ‘Hold’ from ‘Buy’ and lowered the price target to DKK 300 ($46.31) from DKK 445. The brokerage said Novo’s EVOKE and EVOKE-plus trials did not show superiority over placebo in slowing Alzheimer’s progression, which removed a “key potential driver” for offsetting GLP pricing pressures. It added that the expected 2026 impacts from price declines, generics, and weaker Ozempic trends could make growth harder to sustain, and that the market may now wait for “tangible execution evidence” for the obesity segment's volume potential.

JPMorgan Calls Selloff An ‘Overreaction’

JPMorgan said the selloff in Novo shares following the trial failure was an “overreaction.” The firm noted that while the news removes a potential upside share driver, there is “limited to no impact on Novo forecasts.” JPMorgan maintained an ‘Overweight’ rating on the company.

Trial Results

Novo Nordisk said that the two late-stage clinical trials enrolled 3,808 adults between the ages of 55 and 85 with early-stage symptomatic Alzheimer’s disease. While semaglutide demonstrated improvements in disease-related biomarkers in both studies, it did not meet the goal of delaying cognitive decline compared with placebo. The company said that the program is being discontinued, but that the data will be used to further understand the effects of semaglutide in type 2 diabetes, obesity and related conditions.

Novo had described the Alzheimer’s program as a “lottery ticket,” acknowledging the uncertainty of success while still testing the hypothesis using real-world evidence, preclinical models, and post-hoc analyses from its diabetes and obesity trials. The company plans to present topline findings in December, with full data to follow in March.

Impact On The Alzheimer’s Treatment Landscape

The results reinforce long-standing skepticism among analysts about the prospects of GLP-1 drugs in Alzheimer’s disease, with UBS previously estimating only a 10% chance of success. Alzheimer’s remains a challenging field with limited approved treatment options, with most attempts over decades ending in failure.

Prothena, which has partnered with Novo on other programs, shifted its valuation focus to Novo and Roche’s late-stage assets after removing its own Alzheimer’s candidate, PRX012, from its model. Analysts noted that both partner programs will take several years to reach the market and face uncertainties around competitive positioning and clinical efficacy.

Meanwhile, Biogen’s shares ended 1% higher on Monday after Novo’s update, as its antibody therapy Leqembi, developed with Eisai, remains one of the few U.S.-approved options shown to slow Alzheimer’s progression, alongside Eli Lilly’s Kisunla. Both drugs are administered through infusions or injections and carry notable side-effect risks.

Stocktwits Traders Slam ‘Ridiculous’ Selloff

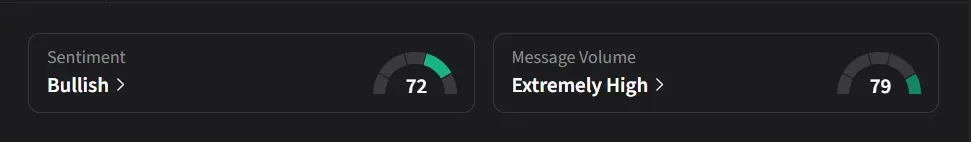

On Stocktwits, retail sentiment for Novo Nordisk was ‘extremely bullish’ amid a 5,509% surge in 24-hour message volume.

One user said the market reaction looked exaggerated, noting that expectations for semaglutide in Alzheimer’s were already low and the decline seemed out of proportion to the news, even as they viewed Eli Lilly more favorably and saw Novo as a short-term trading opportunity.

Another user called the stock’s decline “quite possibly the most ridiculous sell off ever.”

Novo Nordisk’s U.S.-listed stock has declined 47% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2200882557_jpg_53f3e467bc.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Seagate_jpg_50a56724b4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262656307_jpg_562c79e1bd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2202349941_jpg_3f45878d03.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_hims_stock_logo_resized_jpg_5554a2a2c1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_540185275_jpg_21d1350875.webp)