Advertisement|Remove ads.

Nvidia’s China Shipments Hit New Hurdle As US Imposes Security Review On H200 Chips: Report

- China-bound H200 chips will be screened in the U.S. before export under the new arrangement.

- The routing helps enable a 25% government revenue share without violating export-tax rules.

- Nvidia’s China revenue has continued to shrink under tightening U.S. export controls.

The artificial-intelligence chips Nvidia is permitted to ship to China will reportedly undergo a special U.S. national-security screening before export, introducing an uncommon layer of oversight as Washington moves forward with the controversial arrangement.

Chips To Transit Through US For Screening

Nvidia’s H200 AI chips, primarily manufactured in Taiwan, will reportedly be routed to the U.S. for a security review before being exported to China, according to a Wall Street Journal report.

U.S. law bars export taxes, sending the chips through the U.S. could reportedly allow the government to treat its planned 25% revenue share as an import fee or tariff instead, the report said.

Chris McGuire, a former Biden administration export-controls official and now a senior fellow for China and technology at the Council on Foreign Relations, told WSJ that the deal appears driven more by Nvidia’s commercial interests than national-security priorities. McGuire has argued that large-scale H200 sales risk narrowing the U.S. lead in AI computing power.

National-Security Risks Under Debate

U.S. President Donald Trump said Monday that only “approved customers” would receive the chips. However, enforcement remains challenging as that same day, the Justice Department charged two businessmen with trafficking export-controlled Nvidia parts, including the H200, to China and other countries.

Nicholas Ganjei, U.S. attorney for the Southern District of Texas, emphasized the stakes when announcing the charges, saying the country that controls the most advanced chips “will control the future,” WSJ noted.

Meanwhile, Nvidia said it does not see large-scale smuggling of its products. CEO Jensen Huang has dismissed suggestions that the Chinese military would use Nvidia chips, saying Beijing would avoid relying on U.S. hardware for security reasons.

Nvidia’s China Business Shrinks

Nvidia’s China revenue has steadily declined amid successive export restrictions. China and Hong Kong accounted for 7.6% of total revenue in the first nine months of 2025, down from 26% in 2021. The China-specific H20 chip generated roughly $50 million in the latest quarter, a small fraction of Nvidia’s broader business.

The U.S. approval concerns an older-generation chip released in 2024. Nvidia has since launched Blackwell-based accelerators and plans to introduce the Rubin architecture in 2026.

According to the Institute for Progress, the H200 remains significantly more powerful than the H20 and is widely used in top global GPU clusters. The think tank has said that Huawei cannot produce a comparable chip until at least late 2027 and that China’s overall AI chip production capacity remains well below U.S. levels.

China Pursues Domestic Alternatives

Beijing is reportedly weighing limits on domestic use of the H200 despite U.S. approval for its export, reflecting concerns about security and dependence on foreign hardware.

China continues to invest heavily in homegrown semiconductor firms. Cambricon has vowed to triple AI-chip production next year, Huawei has introduced the Ascend 910C with performance approaching some Nvidia offerings, and Moore Threads surged more than 400% in its recent public debut. Baidu also plans to list its $3 billion chip unit Kunlunxin in Hong Kong.

How Did Stocktwits Users React?

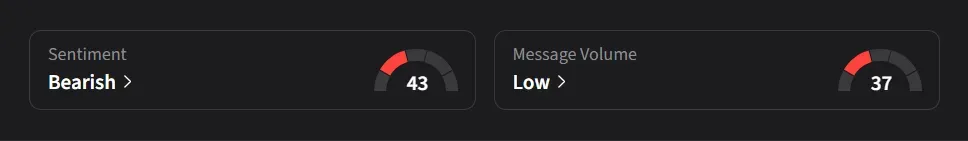

On Stocktwits, retail sentiment for Nvidia was ‘bearish’ amid ‘low’ message volume.

Nvidia’s stock has risen 38% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1813801150_jpg_9e452258fa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2190302521_jpg_796f64970e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194612888_1_jpg_5f7b7f6186.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1384896168_jpg_87fab3f04d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263571605_jpg_f769289486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)