Advertisement|Remove ads.

Occidental Petroleum Stock In Focus As Oil Firm Looks To Sell Oxychem Unit For $10B: Report

Occidental Petroleum (OXY) stock is likely to garner attention on Monday after a report stated that the company is considering the sale of its Oxychem unit in a deal valued at $10 billion.

The Financial Times reported that the Houston-based oil and gas producer is working with advisors for a potential sale, which will carve out one of the world’s largest standalone petrochemicals units.

Unless the Warren Buffett-backed company hits any last-minute roadblocks, the report stated that the deal could be announced in the coming weeks, citing two people familiar with the matter. The report added that the newspaper was unable to determine the identity of the buyers, and the people warned that the sale could still fall through.

The Oxychem unit generated earnings of over $1.1 billion in 2024. However, the unit and its peers are facing a global supply glut alongside continued sluggish growth in certain parts of the world following the COVID-19 pandemic.

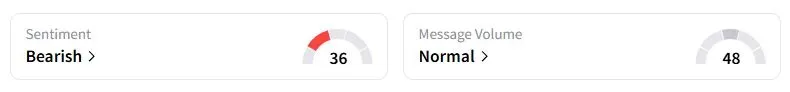

Retail sentiment on Stocktwits about Occidental was in the ‘bearish’ territory at the time of writing.

Any potential deal could help Occidental offload some of the debt burden from its twin acquisitions of Anadarko Petroleum for $55 billion and CrownRock for $12 billion. Its long-term debt stood at $23.34 billion as of June 30.

Since the company unveiled the CrownRock deal in late 2023, it has already closed divestitures worth over $4 billion and repaid $7.5 billion in debt. The Oxychem unit sale will help the firm far exceed its divestiture target of $4.5 billion to $6 billion, set on the heels of the acquisition of the Permian Basin-based oil producer.

“We are pleased with how we continue to strategically strengthen our portfolio, and it’s rewarding to see those efforts drive debt reduction,” CEO Vicki Hollub said in August.

Occidental Petroleum stock has fallen 5.3% this year, compared with 8.3% gains in Exxon Mobil share prices and a 10% jump in Chevron shares.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2241292402_jpg_9661b0c852.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2058827032_jpg_5505a2a083.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_526218674_jpg_7b7468812b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_539991424_jpg_eeab1e0e26.webp)