Advertisement|Remove ads.

ON Semiconductor Stock Rebounds After Sell-Off, But Price-Target Cuts Pile Up: Retail’s Losing Faith

ON Semiconductor (ON) shares climbed 2.2% in morning trading on Tuesday, recovering slightly after plunging to a more than two-year low in the previous session on the back of a disappointing earnings report.

The weaker-than-expected fourth-quarter (Q4) results triggered a wave of price target cuts from major Wall Street firms, including JPMorgan, Citi, Mizuho, Wells Fargo, Morgan Stanley, Deutsche Bank, and TD Cowen, according to TheFly.

Baird took one of the most aggressive stances, slashing its price target nearly in half.

ON Semiconductor reported fourth-quarter earnings per share (EPS) of $0.95, falling slightly below its guidance. Revenue came in at $1.72 billion, landing at the lower end of expectations.

The company’s first-quarter outlook added to investor concerns. Management forecasted EPS between $0.45 and $0.55—well below the consensus estimate of $0.89.

Revenue is expected to decline nearly 19% quarter-over-quarter, signaling continued weakness in demand.

Baird analyst Tristan Gerra cut his price target on ON to $48 from $75 while maintaining a ‘Neutral’ rating.

He noted that the company’s factories are running at a historic low of roughly 55% capacity, down from 59% in the prior quarter. The last time utilization levels were this weak was during the 2009 financial crisis and the early months of the COVID-19 pandemic.

Gerra suggested that while margins could improve once demand stabilizes, ON Semiconductor risks losing market share to competitors willing to cut prices.

“The question is whether share loss might occur in core products as well, given the pressure for lower pricing,” Baird wrote in its research note.

To offset the downturn, ON Semiconductor plans to implement cost-saving measures, including manufacturing and product portfolio rationalization, headcount reductions, and potential site closures, according to management commentary during the earnings call.

These initiatives could start having an impact as early as the second quarter of 2025, according to Baird’s report.

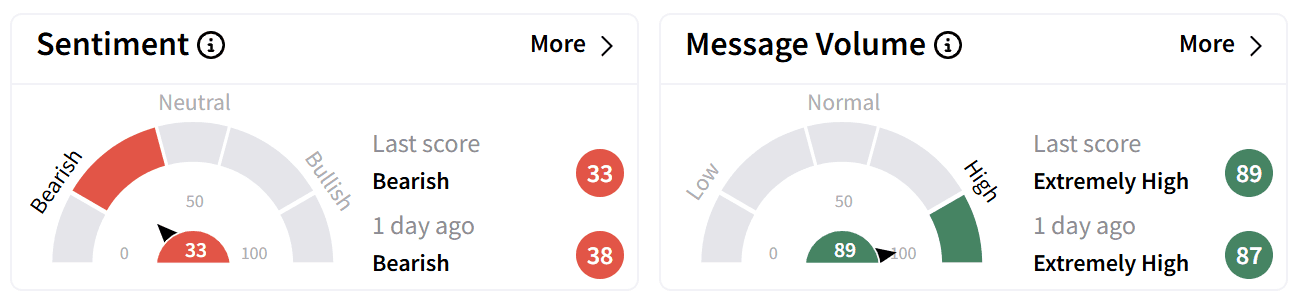

Retail sentiment on Stocktwits remained ‘bearish’ accompanied by ‘extremely high’ chatter as investors on the platform debated the stock’s future outlook.

One user expressed frustration over the stock’s steep decline but said they would continue dollar-cost averaging.

Another saw the drop as a buying opportunity.

According to Koyfin, the average analyst price target for ON Semiconductor now stands at $48.03, implying a potential 36.3% upside from current levels.

Despite Tuesday’s rebound, the stock remains down more than 40% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read more: Bitcoin Miner Hive Digital Stock Holds Steady Before Q3 Earnings, Retail Turns Bearish

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262983094_jpg_2896f12e4a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2033244575_jpg_3f112039eb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2256076198_jpg_06e5c2fdb6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_490939e580.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stablecoin_rep_jpg_5ec196dfc2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228901342_jpg_7365e02c40.webp)