Advertisement|Remove ads.

Why Did OUST Stock Catch Retail Attention In Pre-Market Today?

- Ouster funded the deal through roughly $35 million in cash and 1.8 million shares.

- The acquisition will be treated as a business combination, and StereoLabs will operate as a wholly owned unit of Ouster.

- Ouster will become a single-source provider for synchronized lidar and stereo camera data.

Ouster, Inc. (OUST) garnered retail traders’ attention in premarket trading on Monday after announcing the completion of the acquisition of AI vision specialist StereoLabs SAS earlier this month.

The deal will combine Ouster’s digital lidar with StereoLabs’ advanced camera technology, AI compute, sensor fusion, and perception software to create what Ouster describes as the first end-to-end platform for Physical AI applications.

OUST was among the top trending tickers on Stocktwits at the time of writing, with the stock climbing 2% higher.

StereoLabs Deal Details: Cash, Stock, And 2026 Consolidation

Ouster funded the deal through roughly $35 million in cash and 1.8 million shares, including 0.7 million shares scheduled for release over four years. The acquisition will be treated as a business combination, and StereoLabs will operate as a wholly owned unit of Ouster. StereoLabs’ financial results will be consolidated into Ouster’s statements beginning in the first quarter of fiscal 2026.

StereoLabs Adds Profitable Revenue Stream

StereoLabs generated around $16 million in unaudited revenue in 2025 and brings a positive earnings before interest, tax, depreciation and amortization (EBITDA) business.

New Use Cases: Robotics, Automation, Smart Infrastructure

Ouster will become a single-source provider for synchronized lidar and stereo camera data. The combination is expected to improve software capabilities, expand Ouster’s reach across robotics, industrial automation, and smart infrastructure, and open up emerging use cases such as humanoid robotics and visual inspection.

“This acquisition builds on Ouster’s momentum and positions us as the foundational end-to-end sensing and perception platform for Physical AI,” said Ouster CEO Angus Pacala.

Retail Sentiment On Stocktwits Improves

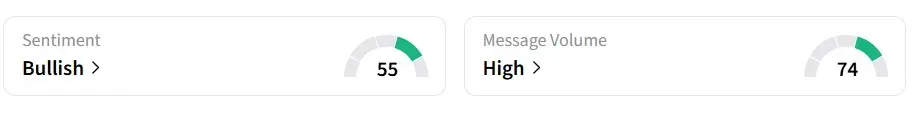

Retail sentiment on Stocktwits flipped to ‘bullish’ from ‘bearish’ a day earlier, amid ‘high’ message volumes.

One user expects the stock to rise all the way right up to its earnings on March 2.

Year-to-date, the stock has shed around 12%, though its gains over the past year exceed 86%.

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1813801150_jpg_9e452258fa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2190302521_jpg_796f64970e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194612888_1_jpg_5f7b7f6186.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1384896168_jpg_87fab3f04d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263571605_jpg_f769289486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)