Advertisement|Remove ads.

Papa John’s Stock Surges After-Hours As Apollo Reportedly Sweetens Buyout Bid — Retail Traders Are Ecstatic

Papa John's International, Inc.'s stock rose 13% to $55.31 in extended trading on Tuesday after Reuters reported that Apollo Global Management had submitted a higher bid to acquire the pizza chain.

The investor is seeking to take the company private for $64 per share, Reuters reported, citing unnamed sources. Apollo and Irth Capital Management had earlier submitted a joint bid of $60 per share, according to reports in June.

Reports of the takeover interest have been circling again, pushing the company's stock higher. PZZA shares rose about 10% on Monday, and then 6.7% the next day, taking their year-to-date gains to 18.5%.

Reuters reported that the deal isn't guaranteed and the talks are fluid, adding that other investors have also expressed interest in the pizza chain.

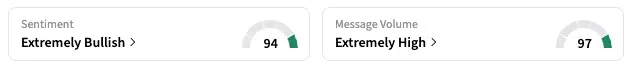

On Stocktwits, retail sentiment for PZZA was 'extremely bullish' late Tuesday, accompanied by 'extremely high' message volume. "$PZZA tomorrow runs to 60," posted one bullish user.

The deal discussions come at a time of weakness for the restaurant industry, as consumers — pressured by high inflation, economic uncertainty, and rising job losses — continue to cut back on discretionary spending such as dining out.

That said, private equity firms have shown a growing appetite for restaurant chains in recent years. Deals have included buyouts of brands such as Subway, Dave's Hot Chicken, and Jersey Mike's.

Papa John's, which operates around 6,000 restaurants in roughly 50 countries and territories, had a market cap of $1.6 billion as of Tuesday.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_tariffs_jpg_d7661eb31a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227347257_jpg_81c3539d3f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2204003106_jpg_405e036a7c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ondas_OG_jpg_05cf209e61.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_peter_tuchman_jpg_fb781e7355.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)