Advertisement|Remove ads.

Pegasystems Stock Retreats To Nearly 3-Month Low Despite Q4 Beat: Retail Sentiment Soars

Pegasystems, Inc. (PEGA) shares plunged early Thursday after the company reported a slowdown in a key user metric in its fiscal year 2024 fourth-quarter results.

However, the quarterly results from the enterprise artificial intelligence (AI) decisioning and workflow automation firm exceeded expectations.

Cambridge, Massachusetts-based Pegasystems reported fourth-quarter adjusted earnings per share (EPS) of $1.61, down from the year ago’s $1.77, and revenue of $490.83 million, up a modest 3% year over year (YoY).

The numbers bettered the consensus estimates of $1.47 and $471.22 million, respectively.

The company said its total annual contract value (ACV) grew 9% YoY to $1.37 billion as of Dec. 31, slower than the 16% growth at the end of the third quarter. The growth of Pega Cloud ACV also slowed to 18% from 30%.

Pega founder and CEO Alan Trefler said the reaction of clients and partners to the company’s innovative solutions has been remarkable in 2024, leading to deeper engagement and newer opportunities.

CFO Ken Stillwell said, “We met or exceeded our financial objectives for 2024 including becoming a Rule of 40 company.” He also noted that Pegasystems is committed to accelerating growth and cash flow in 2025 and beyond.

Looking ahead, Pegasystems said it expects ACV growth of 12% in 2025, $455 million in cash flow from operations and $440 million in free cash flow.

It guided 2025 adjusted EPS to $3.10 and revenue to $1.6 billion, which was in line with the consensus estimates, according to Yahoo Finance.

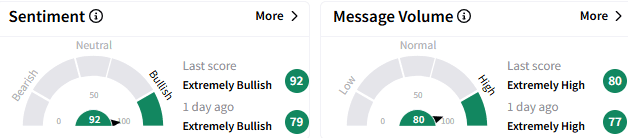

On Stocktwits, sentiment toward Pegasystems stock turned ‘extremely bullish’ (85/100) from ‘bullish’ a day ago, with the message volume spiking to ‘extremely high’ levels.

A watcher said dips such as this should be used as buying opportunities.

The stock fell 16.73% to $88.35 in early trading, marking the lowest level since late November. The down-move was the worst since May 2023.

Pegasystems stock has gained about 14% so far this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)