Advertisement|Remove ads.

Peter Schiff Says 2026 Is 'When It Gets Real' For Gold, Silver After 2025 Breakout

- The economist previously stated that investors have accepted that the gold rally is here to stay, after silver’s surge in December.

- He added that investors had avoided buying silver and platinum until now because they expected gold prices to fall.

- Hopes of a rate cut from the Federal Reserve are pushing prices of gold and silver up, according to Lukman Otunuga, a senior research analyst at FXTM.

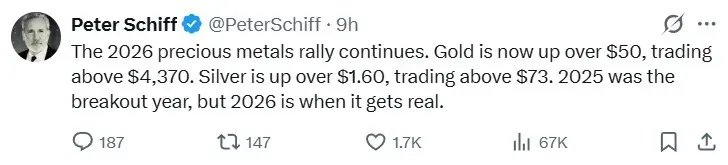

Economist Peter Schiff on Friday stated that 2026 is “when it gets real” for gold and silver, while remaining bullish about the two precious metals.

“The 2026 precious metals rally continues. Gold is now up over $50, trading above $4,370. Silver is up over $1.60, trading above $73. 2025 was the breakout year, but 2026 is when it gets real,” Schiff said in a post on X.

Last month, the economist stated that investors have accepted that the gold rally is here to stay, after silver’s surge in December. He added that investors had avoided buying silver and platinum until now because they expected gold prices to fall.

Spot gold prices were hovering at $4,388 per troy ounce at the time of writing, surging by more than 2% before paring some of the gains. Gold futures maturing in February gained 1.4% to rise to $4,400.

Spot silver prices gained by over 4% to hover at $73.9 per troy ounce. Silver futures maturing in March gained 4.1% to hover around $73.51 at the time of writing.

| Particulars | Change (1-year) |

| Gold | 65.91% |

| Silver | 151.43% |

Rate Cut Hopes Drive Prices Up

Hopes of a rate cut by the Federal Reserve are reportedly pushing up the prices of gold and silver, according to a Reuters report citing Lukman Otunuga, a senior research analyst at FXTM.

“Precious metals have kicked off 2026 on a firmly positive note ... after a bout of profit taking in the last days of 2025, bulls seem to be drawing strength from geopolitical risk and hopes of lower U.S. rates this year,” Otunuga said.

According to data from the CME FedWatch tool, the probability of a 25-basis-point rate cut in January is now at 14.9%, down from 27.3% a month ago. The probability for a 25 bps cut in March remains relatively high, at 42.5%, compared to 39.6% a month ago.

Outlook For 2026

Analysts at ING Think stated in a recent note that gold’s main drivers are still in place. This includes central bank buying, Fed rate cuts, a weaker dollar, concerns about the Fed’s independence, and ETF buying.

“President Trump also recently said he has decided on his pick for the next Fed chair, a candidate that the market expects will push for lower interest rates. All of these factors will benefit gold. We see gold prices hitting more record highs in 2026,” the firm stated.

According to a CNBC report, Kelvin Wong, OANDA’s senior market analyst, is more optimistic. Wong expects gold to move toward $5,000 in the first half of 2026, while silver prices could rise to $90. UBS analyst Giovanni Staunovo said gold prices could be on track to hit $5,000 per troy ounce in 2026, according to a Reuters report.

The SPDR Gold Shares ETF (GLD) was up 2.02% at the time of writing, while the iShares Gold Trust ETF (IAU) was up 2.04%. The GLD and IAU ETFs have both surged 64% over the past 12 months.

The iShares Silver Trust ETF (SLV) was up 4.25% at the time of writing, while the abrdn Physical Silver Shares ETF (SIVR) was up 4.26%. The SLV and SIVR ETFs are both up 144% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_uniqure_jpg_33b6552285.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sharp_Link_Gaming_jpg_60ce5684e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_new_york_stock_exchange_jpg_e1f85c0d8c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243050664_jpg_37b52748e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_hims_stock_logo_resized_jpg_5554a2a2c1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_drill_06147e8349.webp)