Advertisement|Remove ads.

Ranger Energy Services Stock Rises After The Bell On Upbeat Q4 Revenue, Retail’s Unconvinced

Ranger Energy Services (RNGR) gained in aftermarket trade on Monday after the company’s fourth-quarter revenue narrowly topped Wall Street’s estimates.

The company reported fourth-quarter revenue of $143.1 million, while analysts, on average, expected the company to post $142.6 million in revenue, according to FinChat data.

The company’s net income rose to $5.8 million, or $0.25 per share, for the three months ended Dec. 31, compared with $2.1 million, or $0.09 per share, last year.

The company’s high specification rigs segment revenue rose to $87 million in the fourth quarter, from $79 million in the year-ago quarter, helped by a 3% rise in hourly rig rates to $751 compared to the previous year, primarily due to the addition of ancillary equipment attached rig packages.

Ranger said its rig hours were 115,900 compared with 107,900 in the year-ago quarter. However, rig hours decreased sequentially.

The company’s wireline services unit revenue fell 46% to $22.6 million in the fourth quarter, due to lower operational activity as the company moved to negate the demand weakness.

Ranger said that frigid weather thus far in 2025 will keep wireline services segment revenue depressed in the first quarter before an expected rebound in the second quarter.

“Despite a largely flat industry backdrop expected this year, we expect key service lines will achieve modest year-over-year growth,” said CEO Stuart Bodden.

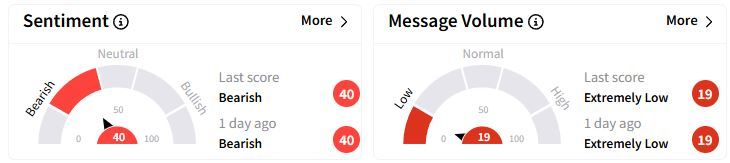

Retail sentiment on Stocktwits remained in the ‘bearish’ (40/100) territory, while retail chatter was ‘extremely low.’

Earlier this year, the top three U.S. oilfield services firms SLB, Halliburton and Baker Hughes flagged weak oilfield activity in 2025.

Over the past year, Ranger Energy shares have gained 50.7%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_qatarenergy_jpg_907aa26daf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262161352_jpg_832967dbca.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243817419_jpg_fd782b2997.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2191224409_jpg_fd3e69e2d7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229305833_jpg_f9b80a181a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tom_Lee_9782f9c21f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)