Advertisement|Remove ads.

Williams Stock In Spotlight On $1.6B Investment For New Energy Infrastructure Project, Retail’s Bullish

Williams Co (WMB) was in focus on Monday after the company said it would invest about $1.6 billion to provide an unnamed firm with committed power generation and associated gas pipeline infrastructure.

The pipeline operator said that, assuming the permits are received in a timely manner, the project is expected to be completed in the second half of 2026.

Williams said that the project is backed by a 10-year, primarily fixed-price power purchase agreement, with an option for the investment-grade customer to extend it. The firm did not reveal the project's location in the regulatory filing.

The company said it would raise its growth capital expenditure by $925 million to a new total between $2.58 billion and $2.88 billion.

“This is the company’s first power innovation project to deliver speed-to-market solutions for growing demand in grid-constrained markets,” Williams said.

Power demand in the U.S. has surged recently, backed by increased consumption from artificial intelligence data centers.

According to a Lawrence Berkeley National Laboratory report, data centers are expected to consume between 6.7% and 12% of total U.S. electricity by 2028, up from 4.4% in 2023.

In 2024, the company had announced six transmission projects to add 885 million cubic feet per day (mmcf/d) of capacity to serve key demand centers.

In February, Williams had topped Wall Street’s quarterly profit and revenue estimates, aided by contributions from newly acquired assets.

The company had also raised its adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) forecast by 3% at the midpoint to $7.65 billion.

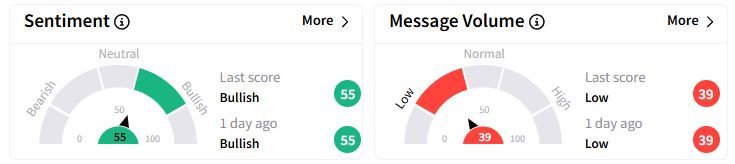

Retail sentiment on Stocktwits remained in the ‘bullish’ (55/100) territory, while retail chatter was ‘low.’

Over the past year, Williams stock has gained 58.2%.

Also See: Oil Stocks Feel The Heat As OPEC+ Proceeds With Production Raise, Retail’s Still Bullish

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_altcoins_5a22b361ff.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)