Advertisement|Remove ads.

Reddit Stock Rallies Ahead Of Q4 Print But Retail Loses Sleep Over Heady Valuation

Red-hot Reddit, Inc. (RDDT) stock faces a key test as the community-focused social-media platform releases fiscal year fourth-quarter results after the market closes on Wednesday.

Analysts, on average, expect Reddit to report fourth-quarter earnings per share (EPS) of $0.25 and revenue of $404.88 million. The guidance issued in late October modeled revenue of $385 million to $400 million and adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) in the range of $110 million to $125 million.

Investors may also focus on the daily active unique user count, which climbed 47% year over year (YoY) to 97.2 million. Weekly active unique users averaged 365.4 million, a 53% increase. Average revenue per user (ARPU) rose 14% to $3.58.

Reddit achieved reported profitability in the third quarter and generated operating cash flow of $70.3 million.

Reddit tested Reddit Answers during the fourth quarter, with the new feature being an artificial intelligence-driven conversational interface.

In the run-up to the quarterly print, several analysts raised their price targets for Reddit stock, The Fly reported.

Raymond James increased the target to $250 from $200 on Monday and maintained a ‘Strong Buy’ rating, and Deutsche Bank analyst Benjamin Black lifted the target to $235 from $195.

Last week, Seaport Research initiated stock coverage with a ‘Neutral’ rating, given the brokerage’s view that it has already discounted continued revenue strength and upside compared to consensus estimates.

However, the firm remained positive regarding Reddit’s fundamentals and predicted continued user momentum. It views the platform as attractive for advertisers, with significant monetization opportunities.

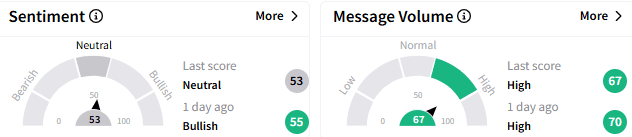

On Stocktwits, sentiment toward Reddit stock remained stuck in ‘neutral’ (53/100) but the message volume stayed at ‘high’ levels.

Some retail investors are also uneasy about the valuation. They see the earnings as a “sell-the-news” event.

Another user pinned their hopes on strong earnings and predicted a $600+ price level by the end of the year.

Reddit stock has been in a steady uptrend since its listing on the Nasdaq on March 21. Since then, the stock has gained about 324%. The year-to-date (YTD) gain is a strong 31%.

It currently trades off its all-time high of $230.41, hit earlier this week.

For updates and corrections, email newsroom[at]stocktwits[dot]com

Read Next: Freshworks Analysts Boost Price Targets After Solid Q4 Results, But Retail Turns Cautious

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)