Advertisement|Remove ads.

Retail Investors Cheer Ford’s Decision To Expand F-Series Production At Canadian Plant Previously Reserved For EV Production

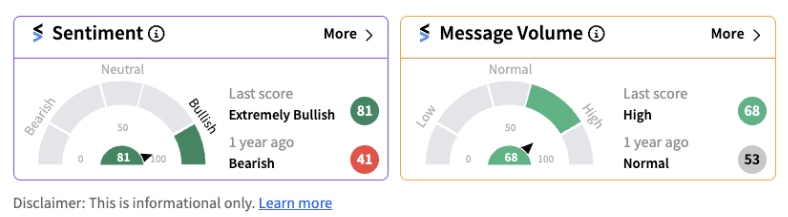

Retail sentiment flipped into the extremely bullish territory (80/100) for Ford Motor Co after the company announced it will invest approximately $3 billion to expand its F-series Super Duty production and said it will assemble the pick-ups at its Oakville Assembly Complex in Ontario, Canada, starting in 2026. The $3 billion investment is inclusive of a $2.30 billion investment to install assembly and integrated stamping operations at the Oakville Assembly Complex.

Ford said the move to add production of up to 100,000 units of its best-selling Super Duty to Oakville expands Super Duty production across three plants in North America. This includes Kentucky Truck Plant and Ohio Assembly Plant, which are operating at full capacity.

The facility was earlier reserved for Ford’s electric vehicle (EV) production. Last year, Ford had announced it will invest about $1.30 billion in the Oakville Assembly plant for a transition of the facility to a new electric hub. The latest development comes in the wake of a slowing electric vehicle market and intensifying competition in the space, and shows Ford is trying to squeeze more profits from its internal combustion engine (ICE) vehicle lineup while it can.

Goldman Sachs recently stated that sales momentum for EVs is slowing globally, and hybrids (HEVs) and plug-in hybrids (PHEVs) are proving more competitive than first thought.

“We’re seeing rising concerns around EV capital costs due to lower prices being realized for used EVs. In the UK, for example, EV used car prices have fallen sharply in recent months. Two, uncertainty around a number of elections this year has decreased visibility on potential changes to government policies affecting the EV industry,” the firm said while adding that rapid charging station infrastructure issues have emerged as a tangible problem.

Shares of Ford were trading nearly 2% higher on Thursday. The stock has returned over 21% since the beginning of the year.

Recently, Barclays analyst reportedly maintained a ‘Buy’ rating on the stock with a price target of $17. The stock is currently trading at $14.77, indicating an upside potential of 15%.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1813801150_jpg_9e452258fa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2190302521_jpg_796f64970e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194612888_1_jpg_5f7b7f6186.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1384896168_jpg_87fab3f04d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263571605_jpg_f769289486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)