Advertisement|Remove ads.

Rocket Lab Gets Slew Of Price Target Cuts Following Q4 Earnings Report: Retail Shrugs It Off

End-to-end space company Rocket Lab USA Inc (RKLB) received several price target cuts from Wall Street analysts following its fourth-quarter earnings report, which saw weaker-than-expected guidance.

According to TheFly, Stifel lowered its price target on the stock to $27 from $31 while keeping a ‘Buy’ rating on the shares. The firm noted that a "solid" fourth quarter (Q4) was overshadowed by softer first-quarter (Q1) guidance and the "slight" push out of the Neutron timeline to the second half of 2025.

At the same time, Stifel also believes that any pullback in the share price "creates a better entry point for investors" as growth will resume in the second quarter and accelerate in the second half of the year.

Rocket Lab projected revenue between $117 million and $123 million for the first quarter, compared to an analyst estimate of $135.67 million per FinChat data.

The space company highlighted that it expects the launch of its reusable medium-lift Neutron rocket in the second half of 2025.

Meanwhile, Roth MKM lowered its price target on Rocket Lab to $25 from $30 while keeping a ‘Buy’ rating on the shares.

KeyBanc analyst Mike Leschock lowered the firm's price target to $28 from $32 while keeping an ‘Overweight’ rating on the shares. According to the brokerage, Rocket Lab is on track to follow an aggressive growth trajectory as SpaceX and is positioned to be an industry leader in both launch services and satellite manufacturing/design.

Notably, Citi analyst Jason Gursky also lowered the firm's price target on Rocket Lab to $33 from $35 while keeping a ‘Buy’ rating on the shares. Interestingly, all new price targets are higher than the stock’s current price of about $19.78.

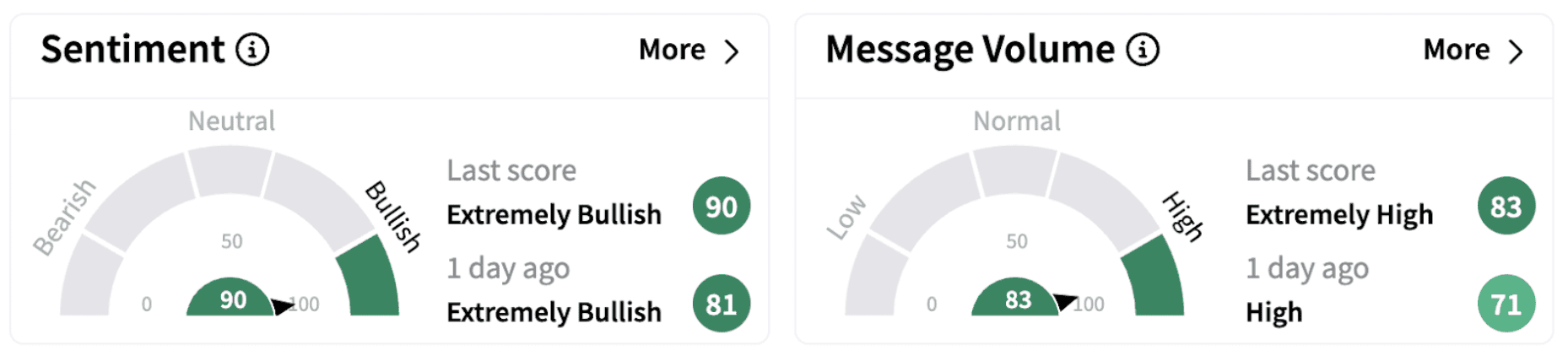

On Stocktwits, retail sentiment climbed further into the ‘extremely bullish’ territory (91/100), accompanied by significant retail chatter.

Retail chatter on Stocktwits showed a mixed take on the stock.

On Thursday, Rocket Lab disclosed that it has signed one of its largest Electron launch agreements in a second multi-launch deal with Institute for Q-shu Pioneers of Space, Inc. (iQPS), a Japan-based Earth-imaging company.

RKLB shares have lost over 20% this year but are up over 330% over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_hut8_OG_jpg_66d77fe261.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_klarna_OG_jpg_830d4c6bf5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194650023_jpg_2af2244b5a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669423_jpg_f410427536.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_cathie_wood_OG_2_jpg_c5be4c4636.webp)