Advertisement|Remove ads.

Sezzle Stock Spikes In Extended Trading After Robust Q4 Earnings, Fuels Retail Frenzy

Sezzle stock (SEZL) jumped 15.6% in aftermarket trading on Tuesday after the digital payments platform’s fourth-quarter earnings exceeded Wall Street’s expectations.

According to FinChat data, the company posted an adjusted net income of $4.39 per share for the fourth quarter, while analysts, on average, expected it to report $3.04 per share.

Its quarterly revenue doubled to $98.2 million and topped Wall Street’s estimate of $73.9 million.

Sezzle’s gross merchandise volume, which denotes the total value of transactions on the platform, hit a new high of $855.4 million, aided by strong holiday season demand and the positive impact of its partnership with WebBank partnership.

Through the partnership with WebBank, the company launched Sezzle On-Demand, which allowed non-Sezzle subscribers to use the platform for a one-time fee.

The buy-now-pay-later company’s monthly on-demand and subscribers count rose to 707,000 from 307,000 in the year-ago quarter.

The company’s active consumers rose 4.8% to 2.73 million during the fourth quarter.

Sezzle raised its 2025 net income per share forecast to $13.25 from its earlier projection of $12.

The company expects total revenue growth between 25% and 30% this year.

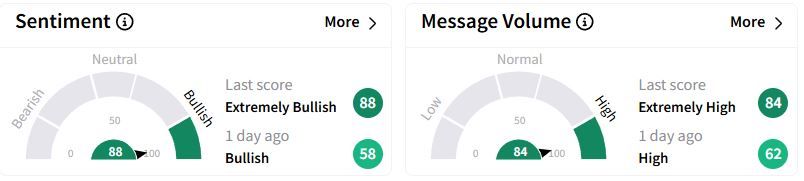

Retail sentiment on Stocktwits jumped to ‘extremely bullish’ (88/100) territory from ‘bullish’(58/100) a day ago, while retail chatter rose to ‘extremely high.'

One bullish investor hoped that the company would start paying dividends soon.

In December, now-disbanded short-seller Hindenburg alleged that Sezzle was borrowing expensive capital to make ‘extremely risky loans’ and that the platform was rapidly losing customers and merchants.

Sezzle had denied the allegations and said they were ‘misleading and out of context.’

Over the past year, Sezzle stock has grown more than sixfold.

Also See: Extra Space Storage Stock Rises After Upbeat Q4 Core FFO, Retail Sits On The Fence

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250241035_jpg_937df85f43.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kashkari_original_jpg_b7db42a385.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2199401088_jpg_656c1eacd4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1236271712_jpg_16001d2299.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Figma_jpg_4536c33786.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2219201717_1_jpg_a4257a5acc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)