Advertisement|Remove ads.

Shoals Stock Tumbles After BNP Paribas Downgrades On Nextracker Challenge, Retail Bulls Hold Ground

Shoals Technologies Group (SHLS) shares slumped 25% on Thursday after BNP Paribas Exane downgraded the stock to ‘Underperform’ from ‘Neutral.’

According to TheFly, the brokerage lowered the stock’s price target to $4 from $4.50. According to FinChat data, Shoals has a consensus price target of $6.28.

BNP Paribas noted that Nextracker (NXT) is expanding into the market where Shoals operates and is probably speaking with all of Shoals' customers, as it captures 50%-60% of the solar tracker market.

Shoals designs and sells electrical balance of system (EBOS) products, which include components such as cables, wireless monitoring systems, and junction boxes.

Nextracker said on Wednesday it would acquire U.S.-based Bentek Corp, a rival of Shoals, for $78 million in cash.

“Bentek has the ingredients to become a larger player in the U.S., but they were lacking financial support,” Nextracker CEO Dan Shugar had said on a call with analysts.

BNP Paribas believes Nextracker is continuously improving costs and its supply chain. It said the company will be bundling, optimizing, and expanding capacity while noting that “Shoals can’t catch a break.”

The brokerage also thinks that the product difference might not matter.

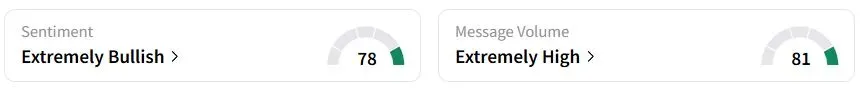

Retail sentiment on Stocktwits was in the ‘extremely bullish’ (78/100) territory, while retail chatter was ‘extremely high.’

“All of SHLS's competition have been small-time players with inferior products. NXT has deep pockets, which means they are going to try to come up with a better solution than what SHLS can offer,” one user said.

“NXT/Bentek is the first in what will be further integration and consolidation in the solar sector of which Shoals will be the most appealing target/partner,” another retail trader commented.

Shoals stock has fallen nearly 19% year to date (YTD).

Also See: Deere Stock Draws Retail Chatter After Q2 Beat, Sees Pre-Tax Tariff Impact Of Over $500M In 2025

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227347257_jpg_81c3539d3f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2204003106_jpg_405e036a7c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ondas_OG_jpg_05cf209e61.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_peter_tuchman_jpg_fb781e7355.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243967992_jpg_85ede3fab5.webp)