Advertisement|Remove ads.

Super Micro Stock Rockets As Nvidia-Powered AI Data Center Reaches Full Production Availability: Retail Bulls Charge In

Super Micro Computer, Inc. (SMCI) shares soared over 8% Wednesday morning, crossing the $30 barrier, following a product update from the company.

San Jose, California-based Super Micro announced the full production availability of its end-to-end artificial intelligence (AI) data center “Building Black Solutions.”

The company noted that the Building Block portfolio provides core infrastructure elements necessary to scale Nvidia Corp.'s (NVDA) Blackwell solutions with exceptional time to deployment.

The portfolio comprises air-cooled and liquid-cooled systems with multiple CPU options, a full data center management software suite, and rack-level integration, including network switching and cabling.

Charles Liang, president and CEO of Supermicro, said, “In this transformative moment of AI, where scaling laws are pushing the limits of data center capabilities, our latest NVIDIA Blackwell-powered solutions, developed through close collaboration with NVIDIA, deliver outstanding computational power.”

He added that the offering empowers customers to deploy infrastructure that supports increasingly complex AI workloads while maintaining exceptional efficiency.

Super Micro announced earlier this week that it would provide a second-quarter update on Feb. 11. The announcement generated positive sentiment as it was construed as a signal that the company’s accounting headwinds may now be in the rearview mirror.

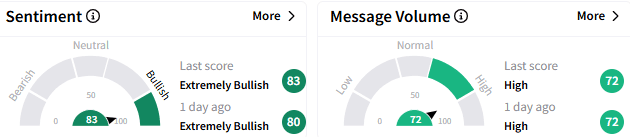

On Stocktwits, retail sentiment toward Super Micro stock stayed ‘extremely bullish’ (83/100), with the degree of optimism increasing from a day ago. The message volume remained ‘high.’

The Super Micro was among the top five trending stock on Stocktwits, and the top 10 active stocks.

A retail watcher shared a technical chart and said the stock will likely have a nice run.

Another user has already set their sights on $50+ next week.

Super Micro stock is down 4.3% so far this year after generating a below-market return of 7.2% in 2024. It is trading way off its March 8th all-time high of $122.90.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Disney Stock Rises As Investors Savor Q1 Beat, In-line FY25 Guidance: Retail Thrilled

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_HQ_logo_5431c7f2ad.jpg)