Advertisement|Remove ads.

Super Micro Stock Rises Premarket After AI Server Maker Schedules Q2 Business Update: Retail’s Confidence Grows

Super Micro Computer, Inc. (SMCI) stock rallied in Tuesday’s premarket trading after the beleaguered artificial intelligence server maker said it would provide its fiscal year 2025 second-quarter business update at 5 p.m. ET on Tuesday, Feb. 11.

In premarket trading, the stock climbed 5.77% to $28.40, reversing the 5.86% loss it experienced on Friday.

According to Yahoo Finance data, analysts expect the company to report second-quarter EPS of $0.63 on revenue of $5.78 billion. This compares to the year-ago quarter’s $0.63 and $3.66 billion, respectively.

Super Micro stock came under pressure in the second half of last year due to accounting issues that culminated in its then-auditor Ernst & Young resigning and the delay in filing its financial statements for the fiscal year 2024 and the first quarter of the next fiscal year.

The company announced preliminary first-quarter results in early November, guiding net sales of $5.9 billion to $6 billion and non-GAAP earnings per share (EPS) of $0.75-$0.76.

Although an independent special committee appointed by the board gave the company a clean bill of health, the negative sentiment did not lift. As the stock continued to slide through late 2024 amid fears concerning potential delisting, the company was removed from the Nasdaq 100 Index.

Super Micro has a Feb. 25 deadline to regain compliance with the Nasdaq listing standards on timely filing of financial statements.

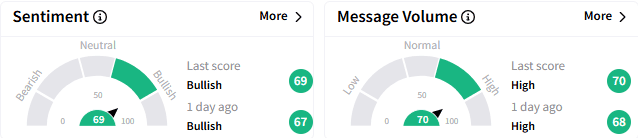

On Stocktwits, retail sentiment toward Super Micro stock stayed ‘bullish’ (69/100), with the message volume remaining at ‘high’ levels.

The stock was among the platform's top ten most active tickers early Tuesday.

A retail stock watcher viewed Super Micro’s announcement as positive, considering that if BDO, the new auditor, had identified any issue, the company wouldn’t have scheduled the update.

Another said they would accumulate more Super Micro stock and hold it until it reaches $45.

Super Micro stock has declined about 12% this year after ending 2024 with an underwhelming gain of 7.2%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_golden_dome_resized_jpg_38d699de1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222922178_jpg_42dd8f319f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/incyte_resized_jpg_4f94b32a2f.webp)