Advertisement|Remove ads.

Snowflake Stock Surges As Wall Street Lifts Price Targets After Q4 Earnings Beat – Retail Cheers CFO Exit

Snowflake Inc. (SNOW) surged nearly 9% in early trading Thursday as Wall Street analysts raised their price targets following the company’s stronger-than-expected fourth-quarter results.

According to TheFly, at least 13 brokerages lifted their price targets on the stock. Cantor Fitzgerald set the highest target at $228, up from $201, while maintaining an 'Overweight' rating.

Retail interest in Snowflake also spiked, making it one of the top trending tickers on Stocktwits. Platform data showed that message volumes surged 504% over the past 24 hours.

Some retail investors even cheered CFO Michael Scarpelli’s impending exit, which was announced early Thursday.

The company has yet to set a retirement date but said Scarpelli would remain in his role until a successor is appointed before transitioning to an advisory position to ensure a smooth handover.

UBS, which raised its target by $10 to $200 with a 'Neutral' rating, noted that while Scarpelli's departure was a setback, it likely would have no direct impact on company performance.

The cloud data firm reported fourth-quarter (Q4) earnings per share (EPS) of $0.30, surpassing the estimated $0.18. Revenue hit $986.7 million, exceeding expectations of $956.9 million and marking a 27% year-over-year increase.

Snowflake also projected a fiscal year 2026 product revenue of $4.28 billion, reflecting 24% annual growth, driven by its core business and new product adoption, though the company acknowledged potential headwinds.

Piper Sandler was encouraged by the company’s triple-digit growth in Snowpark, one of Snowflake’s newer products, which generated over $100 million in revenue for the year. The brokerage raised its price target to $215 from $208, maintaining an 'Overweight' rating.

The company also announced that it continues to expand its strategic partnerships, particularly with Microsoft. The company is integrating its Cortex AI Agents with Microsoft 365 Copilot and Teams, broadening access to millions of users and enhancing productivity.

Wedbush, which reaffirmed its 'Outperform' rating and a $210 price target, noted that Snowflake’s generative AI solutions through Cortex position it well for future growth.

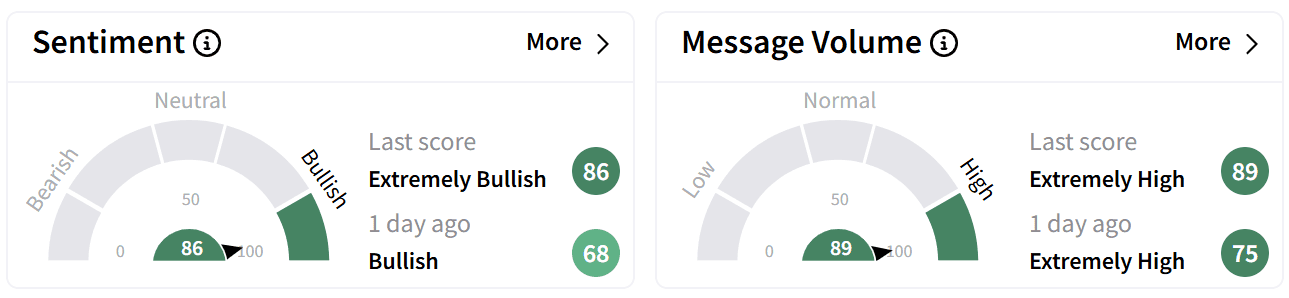

Retail sentiment on Stocktwits surged to ‘extremely bullish’ from ‘bullish’ a day ago, and chatter increased to ‘extremely high’ levels.

Despite the optimism, some retail traders voiced concerns that jobs and GDP data could disrupt the stock’s momentum.

Despite Thursday’s rally, Snowflake's stock remains down 22% over the past year but have gained 14% since the start of 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read also: Nvidia’s Streak of Record-Breaking Quarters Drives Retail To Buy More And Stay Long

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229015958_jpg_095394ad49.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_marathon_holdings_resized_40790d98cc.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250240969_jpg_dd9be8c5ea.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_iran_jpg_753ef9f5af.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_BX_resized_blackstone_jpg_1a169d1a1c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)