Advertisement|Remove ads.

Why Did Sprouts Farmers Market’s Stock Crash 27% On Thursday?

- Shares of Sprouts Farmers Market tumbled 27% in early trade on Thursday.

- SFM shares fell to their lowest levels since June 2024.

- Multiple brokerages, including Barclays, Goldman Sachs, and JPMorgan, cut their price targets on the stock.

Shares of Sprouts Farmers Market Inc. (SFM) tumbled 27% in early trade on Thursday, hitting their lowest level since June 2024, after several brokerages cut their price targets in response to the company’s weaker-than-expected third quarter (Q3) results.

How Did Brokerages React?

Goldman Sachs analyst Leah Jordan lowered the price target to $152 from $178 but kept a ‘Buy’ rating, according to TheFly. The firm expects SFM’s shares to trade lower post Q3 due to softer Q4 guidance, but highlighted resilient profitability and EPS growth as positives.

Barclays trimmed the stock’s price target to $122 from $185 while maintaining an ‘Overweight’ rating. Barclays called Q3 results disappointing due to slower comparable store sales, but emphasized that margins remain well managed, supporting a constructive long-term outlook.

JPMorgan reduced its price target to $91 from $124 and reiterated a ‘Neutral’ stance. It noted a challenging year and a weaker consumer environment, which could pressure near-term sales growth.

UBS lowered its price target to $108 from $118 and kept a ‘Neutral’ rating. The brokerage cited a tougher operating setup ahead, suggesting cautious sentiment following the company’s recent performance.

Mixed Q3 Print

Sprouts Farmers Market’s third-quarter revenue came in at $2.2 billion, slightly below the street expectation of $2.23 billion. Comparable store sales rose 5.9%, while adjusted EPS was $1.22. For the fourth quarter, the company guided flat to 2% comp sales growth and EPS of $0.86 to $0.90.

Sprouts reaffirmed its full-year 2025 outlook, expecting net sales growth of about 14%, comparable sales growth of 7%, and EPS in the range of $5.24 to $5.28.

Stocktwits Users’ Reaction

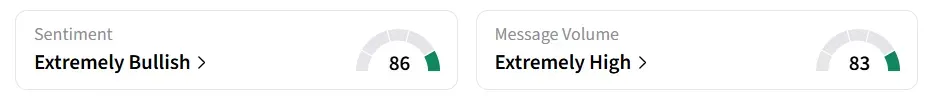

Despite the intraday plunge, retail sentiment on Stocktwits turned ‘extremely bullish’ amid ‘extremely high’ message volumes. It was ‘bearish’ a day earlier.

One user was bullish, expecting the downcycle to last one to two quarters before picking up.

Another user expects the stock to gradually rise to $100.

Year-to-date, the SFM stock has experienced a significant correction, declining by over 38%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_wall_street_resized1_jpg_7f200ce842.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2257784104_jpg_4f7b38e8a2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_jpg_f51342601b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228864541_jpg_d94770c5a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_eric_trump_OG_jpg_19bc149869.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Palantir_jpg_da95861470.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)