Advertisement|Remove ads.

Sunshine Biopharma Unit Launches Generic Anticonvulsant In Canada: Retail Sees ‘Huge Potential’

Shares of Sunshine Biopharma Inc. (SBFM) were in the spotlight on Wednesday after the pharmaceutical company announced that its Canadian unit, Nora Pharma, has launched a new generic prescription drug, Gabapentin.

Gabapentin is an anticonvulsant medication used to treat neuropathic pain and epilepsy, as well as for the treatment of pain caused by various medical conditions by reducing excess excitation of the neural networks in the brain and spinal cord.

Nora Pharma’s Gabapentin is available in strengths of 100 mg, 300 mg, and 400 mg and comes in bottles of 500 capsules.

According to Sunshine Pharma, Canada represents approximately 1.2% of the global pharmaceutical market for Gabapentin, which was valued at $1.92 billion in 2024. It is projected to reach $3.07 billion, the company said.

CEO Steve Slilaty said that the company is attempting to fortify its presence in Canada’s generic drugs market, valued at $9.4 billion. The market is forecasted to nearly double to $19.2 billion by 2032, he added.

Sunshine Biopharma currently has 71 generic prescription drugs on the market in Canada, with over 12 additional drugs planned for launch in the remainder of 2025.

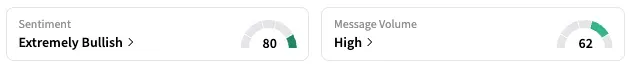

On Stocktwits, retail sentiment around SBFM jumped from ‘bullish’ to ‘extremely bullish’ over the past 24 hours while message volume rose from ‘normal’ to ‘high’ levels.

A Stocktwits user opined that short sellers will not risk shorting Sunshine owing to its significant institutional ownership, low float, and ‘HUGE potential.’

SBFM stock is down by about 46% this year and has wiped out nearly three-quarters of its valuation over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Broadcom_jpg_f302b01f15.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_new_york_stock_exchange_jpg_e1f85c0d8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218181288_jpg_d22b8a81ff.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243840626_jpg_6a78fa8844.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_jeff_merkley_jpg_aca807f10f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)