Advertisement|Remove ads.

Super Micro Stock Bucks Trump Tariff-Induced Broader Market Weakness: Retail Persists With Bullish Stance

Super Micro Computer, Inc. (SMCI) stock is poised to end higher for the first time in four sessions, defying the weakness in the broader market caused by worries about President Donald Trump’s tariff measures.

After rising 12% last Wednesday in reaction to Super Micro becoming current with its financial reports filing, the stock moved downhill despite the positive news concerning a massive manufacturing capacity expansion.

From $51.11 at the close of trading on Wednesday, the stock touched an intraday low of $34.51 on Tuesday, a drop of over 32%. Since then, the stock has fought its way back up. At last check, it traded 5.87% higher at $38.19.

The gains are especially significant as artificial intelligence (AI) frontrunner Nvidia Corp. (NVDA) was seen hugging the unchanged line. Super Micro is a key partner of Nvidia, supplying AI data center systems powered by Nvidia accelerator chips.

On a negative note, a JPMorgan research report released Friday said Super Micro’s 10-K filing highlighted material internal control weaknesses and customer concentration risk,TheFly reported.

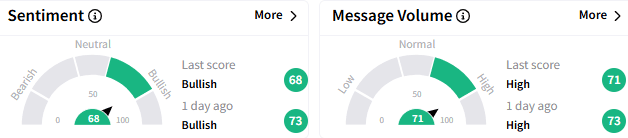

On Stocktwits, retail sentiment toward Super Micro stock remained ‘bullish’ (68/100), and message volume remained at ‘high’ levels.

A bullish watcher pointed to Super Micro’s rally and said the stock could build on gains when the market rebounds.

Another user prodded fellow retailers to accumulate more shares, expecting big news.

Super Micro stock plummeted from its March 8th all-time high of $122.90 as negative catalysts such as accounting issues, auditor resignation, delisting fears amid delays in filing financial reports with the SEC, and the Nasdaq 100 exclusion played out.

It fell to a low of $17.25 in mid-November but rebounded amid optimism over Trump’s re-election.

The stock began to gather solid upward momentum in early February, rising as high as $66.44 on Feb. 19 on an intraday basis. But it has pulled back from that level since then.

For the year-to-date period, the stock is still up over 18%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_HQ_logo_5431c7f2ad.jpg)