Advertisement|Remove ads.

Sydney Sweeney Fuels ‘Meme Stock’ Euphoria For American Eagle Outfitters, Retail Crowd Piles In Amid After-Hours Surge

American Eagle Outfitters (AEO) jumped more than 22% in after-hours trading Wednesday following the launch of a new ad campaign starring actress Sydney Sweeney, fueling speculation that the apparel seller might be the next name to catch a ride on the “meme stock” wave.

As of late Wednesday, chatter on Stocktwits, Reddit, and X picked up sharply, with most users linking the stock's rally to the new ad campaign. Sweeney, best known for her roles in "Euphoria" and "The White Lotus," is one of the most influential celebrities today, and particularly popular among younger audiences.

The ad teases American Eagle's fall collection, which includes limited-edition denim jeans and jackets "inspired" by Sweeney's style.

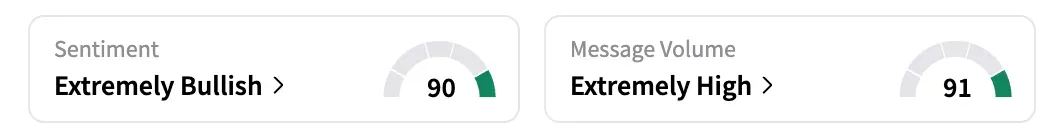

Retail sentiment for AEO on Stocktwits flipped sharply from 'bearish' (24 hours ago) to 'extremely bullish' (90/100) at the time of writing, with AEO climbing into the platform's top 10 trending tickers. Symbol page views and message volume rose to 10 times their monthly average.

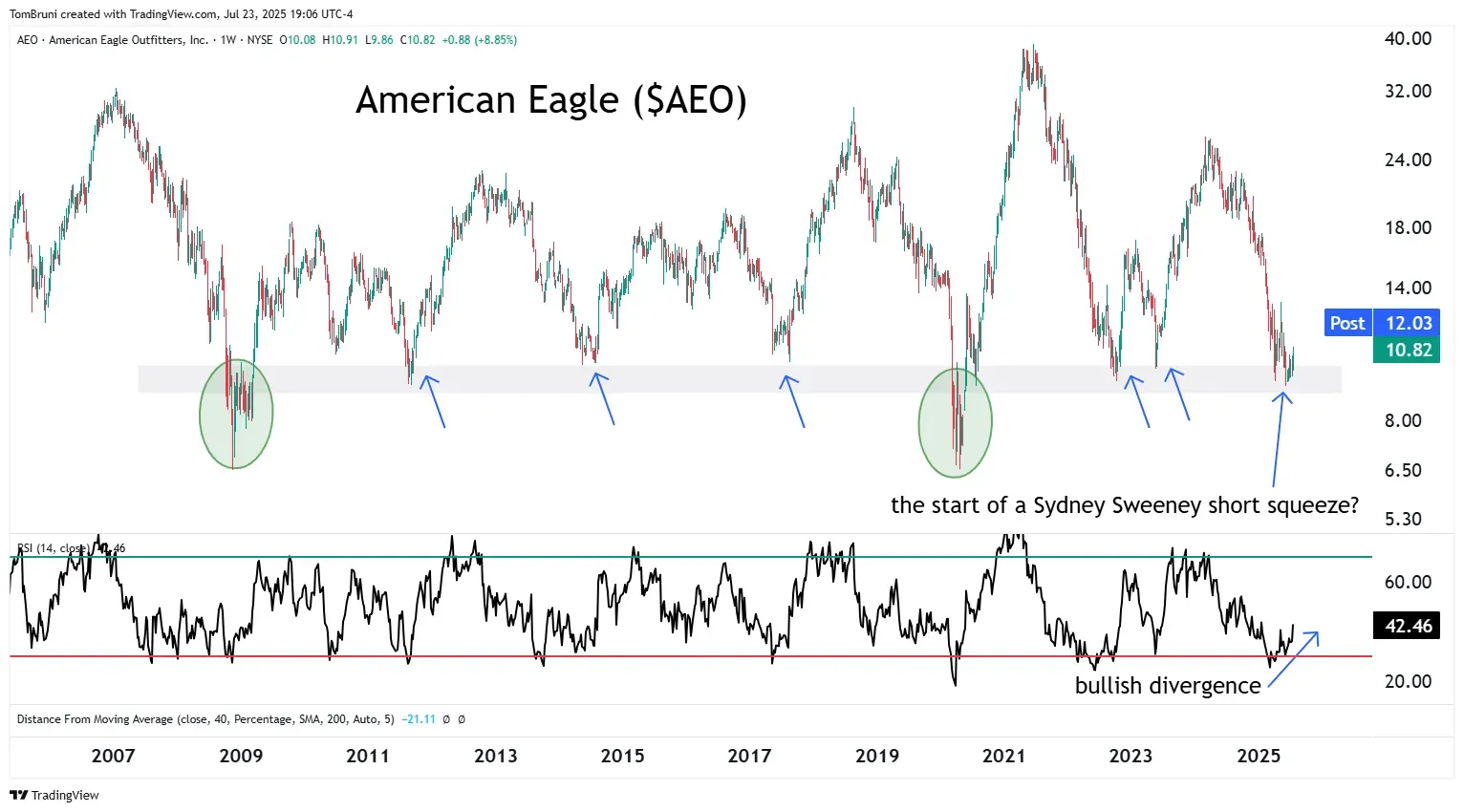

According to Koyfin data, short interest in the stock stands at roughly 12%. AEO shares may be reversing once again from the level near $9 to $10, which has proven to be an inflection point over the last 25 years.

Social media platform X and Reddit forum r/WallStreetBets were also buzzing. "A single Sydney Sweeney ad campaign just created $416,449,000 in value for American Eagle in after-hours trading," an X user posted, while a Reddit user likened the campaign to a “thirst trap.”

Last year, Crocs (CROX) shares got a similar, albeit much smaller, boost after the sandal brand announced Sweeney as its global spokesperson.

In recent days, a resurgent meme stock frenzy has boosted the shares of names like Opendoor Technologies (OPEN), Krispy Kreme (DNUT), GoPro (GPRO), and Kohl's Corporation (KSS).

The rally in American Eagle shares partly reflects hopes that Sweeney's star power will boost sales, but it remains a hard sell. Recent quarters have seen sliding sales and profits, indicating a decline in the brand's consumer appeal.

Results for the last quarter fell short of market expectations, which the company attributed to weak consumer spending and strategic moves that failed to yield the desired results.

As of its last close, American Eagle stock is down 35% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)