Advertisement|Remove ads.

TD Bank Garners Retail Buzz After Q2 Profit Beat, Layoff Plans

TD Bank (TD) drew retail attention after its second-quarter earnings topped expectations and announced a plan to lay off 2% of its workforce.

Under new CEO Raymond Chun, who took office on Feb. 1, TD is looking to move beyond the controversies related to its lapses in preventing money laundering.

In October, the bank agreed to pay $3.1 billion in fines and other penalties to the Department of Justice and other financial regulators.

Reuters reported that the Canadian bank reported adjusted earnings of C$1.97 per share, which topped LSEG estimates of C$1.76 per share.

The company said the layoffs were part of a restructuring plan for which the lender took C$163 million ($117.9 million) in pre-tax charges in the second quarter, primarily related to real estate optimization, employee severance, and other personnel-related costs.

TD expects to incur total restructuring charges of C$600 million to C$700 million pre-tax over the next several quarters.

"We are structurally reducing costs across the bank by taking a disciplined look at our operations and processes to find opportunities to automate and to re-engineer them," Chun said to analysts.

The company’s net income rose to C$11.13 billion, compared with C$2.56 billion a year earlier, as it made gains from selling its stake in Charles Schwab Corp.

“The bank’s U.S. operations will likely remain a short-term headwind as the firm works to reduce its assets, reposition its portfolio, and invest in its governance and controls following its settlement with US regulators,” Morningstar analyst Michael Miller said.

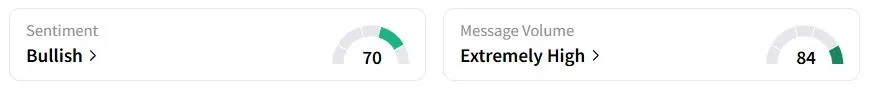

Retail sentiment on Stocktwits jumped to ‘extremely bullish’ (82/100) territory from ‘neutral’(53/100) a day ago, while retail chatter remained ‘neutral.’

“My biggest holding, glad I bought a lot when it crashed in March,” one user said.

TD stock has jumped 25% year to date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227884296_jpg_f4ab8e4dcf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_hims_stock_logo_resized_jpg_5554a2a2c1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_crypto_atm_OG_jpg_ab7e4567eb.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235337353_jpg_bdb561432a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_strait_of_hormuz_jpg_456f2fb6d3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Intuit_resized_jpg_913ef93c15.webp)