Advertisement|Remove ads.

Tesla Stock Snaps 2 Days Of Gains Amid Fierce Robotaxi Battle — Musk Touts ‘Major Valuation Change’ After Arizona Permit Win

- Waymo’s rapid expansion of fully driverless robotaxis heightened competitive pressure on Tesla, weighing on investor sentiment.

- Tesla’s Arizona approval allows it to run a paid ride-hailing service with safety drivers, marking progress but not full driverless clearance.

- Musk attempted to reassure investors by saying Tesla’s valuation could shift significantly once unsupervised self-driving and Optimus production scale up.

Tesla, Inc. shares snapped a two-session gain on Tuesday as a heated robotaxi rivalry with Alphabet’s Waymo intensified, even as the electric vehicle maker secured an Arizona permit to operate a paid ride-hailing service.

Tesla shares fell 1.9%, to $401.25 on Tuesday, snapping a two-session winning streak, and eased a further 0.4% in after-hours trading. The pullback followed a brief drop below the $400 mark last week, marking the stock’s lowest level since mid-September.

Waymo’s Fully Driverless Rollout Tightens Pressure On Tesla

Waymo, owned by Alphabet, widened its fully autonomous robotaxi footprint by rolling out driverless rides in Miami, and it plans to move into Dallas, Houston, San Antonio and Orlando in the coming weeks before opening the service to the public in 2026. The company, which grew out of Google’s early self-driving project, is still the only operator in the country offering paid robotaxi trips without safety drivers or in-car monitors, backed by a fleet of more than 1,500 vehicles.

Its rapid expansion has sharpened investor concerns about Tesla’s competitive position in the autonomous race, contributing to the slide in Tesla's shares.

Tesla’s Arizona Approval Falls Short Of Driverless Clearance

Tesla’s Arizona transportation network company permit allows the company to run an Uber-style ride-hailing service with human safety drivers. The authorization, granted on Monday, does not permit driverless operations. Tesla has separately applied for a permit to test without a human operator.

The company is trying to build out its autonomous services, starting with a monitored robotaxi program in Austin, Texas, where a safety monitor rides in the front passenger seat. Musk has said he wants Tesla to have robotaxis operating in eight to 10 U.S. metro areas by the end of the year, pending regulatory approvals.

Musk Boosts Future Expectations Amid Stock Pressure

Amid the stock’s decline, Musk attempted to rally sentiment through a post on X, writing that a “major valuation change” will occur when Tesla achieves unsupervised self-driving at scale, adding that an “even larger valuation change” is expected once its humanoid robot, Optimus, reaches volume production.

Stocktwits Users Flag Fresh Valuation Doubts

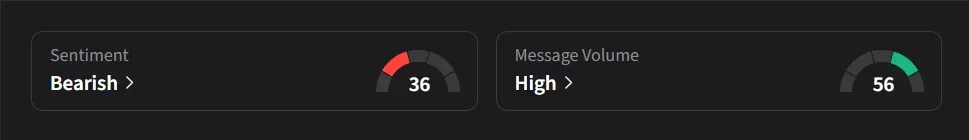

On Stocktwits, retail sentiment for Tesla was ‘bearish’ amid ‘high’ message volume.

One user said, “Waymo launching in five more cities! Tesla getting crushed.“

Another user suggested Tesla’s valuation would look far lower if judged by the same price-to-earnings standards as Ford, arguing the stock could sit under $30 on that basis and warning that Tesla may eventually be priced more like a traditional carmaker than a tech company.

Tesla’s stock has declined 0.6% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)