Advertisement|Remove ads.

The 2025 Weight-Loss Drug Gold Rush: How Eli Lilly Pulled Ahead, Novo Hit A Snag — And A Swarm Of Biotech Underdogs Are Closing In

- Global obesity-drug sales could exceed $130–150B by the mid-2030s, driven by GLP-1/GIP drugs and expanding access beyond the U.S.

- Lilly strengthens its leadership with a deep pipeline, while Novo faces slowing growth, price cuts, and disappointing CargiSema data.

- New entrants—from Wave Life Sciences to Amgen, AstraZeneca, and Pfizer—intensify competition in an expanding market.

The weight-loss category has emerged as pharma’s new sweet spot, propelling Eli Lilly (LLY) to become the first trillion-dollar healthcare company. The momentum hasn’t been limited to the giants—several smaller players have also surged on the back of their obesity drug pipelines. The scramble for dominance in weight-loss therapeutics now mirrors the AI arms race in tech, with companies pouring capital, talent, and research into a market too transformative to ignore.

Wave Life Sciences Ltd.’s (WVE) shares jumped nearly 150% on Monday after the small-cap biotech announced positive interim early-stage trial data for its obesity treatment candidate, codenamed “WVE-007.” Wall Street went gaga over the data, with the stock receiving a raft of generous price target raises and even a few upgrades.

Anti-Obesity Drug Market — Bulky Opportunity

The weight-loss drug market is currently essentially a duopoly — one dominated by Danish pharma giant Novo Nordisk (NVO) and Lilly. But there are hordes of other large-cap pharma giants and small fries waiting in the wings. But is the field lucrative enough to justify the strong interest?

Morgan Stanley in May raised its global weight-loss medication market estimate for 2035 to $150 billion, calling it the peak potential, up from $105 billion. If the forecast proves accurate, the market is expected to grow exponentially, from $15 billion in 2024. According to the firm’s analyst Terence Flynn, “We believe we are now at an inflection point for the broadening of obesity drugs’ use, which will extend beyond the U.S. to larger numbers of patients globally.”

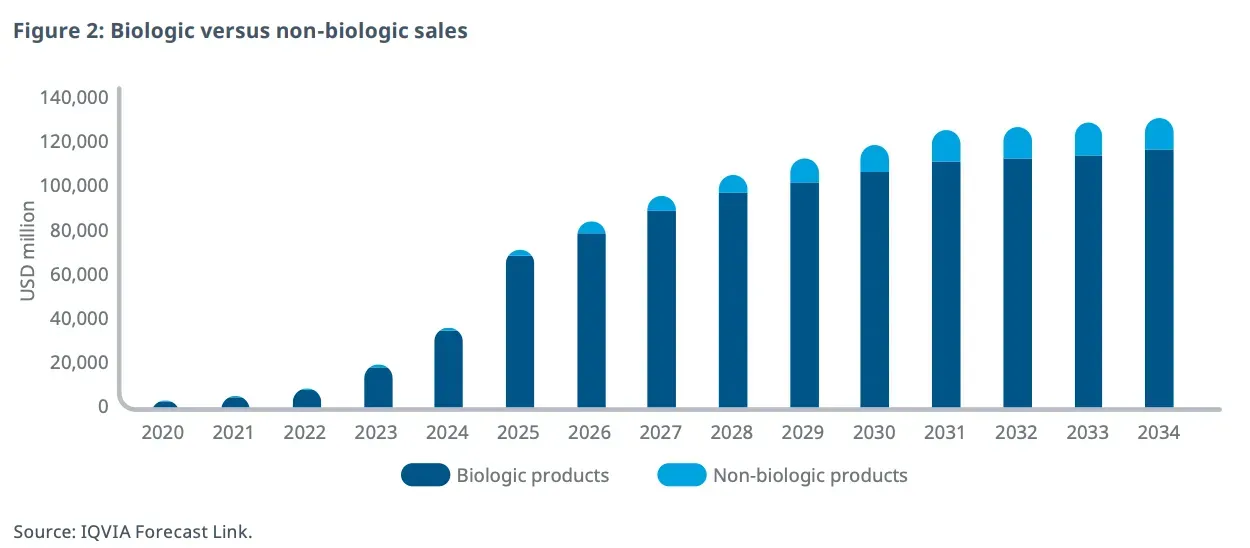

Coherent Market Insights puts the global market opportunity at $82.55 billion by 2032, growing at a compounded annual growth rate (CAGR) of 18% from $25.87 billion in 2025. Health information technology company IQVIA estimates the anti-obesity medication market to grow at a CAGR of 13-15% to $130 billion by 2034.

Obesity Drug Market: Rapid Growth Through 2035

Source: IQVIA

According to McKinsey, nearly one in three adults in the U.S., or about 100 million people, meet the clinical criteria for obesity. Add to this the 900 million people worldwide, and the addressable opportunity swells.

Currently, the market is dominated (96%) by a class of drugs called glucagon-like peptide (GLP-1)/glucose-dependent insulinotropic polypeptide (GIP) receptor agonists. These are injectable drugs that mimic natural gut hormones (GLP-1 and GIP) to slow digestion, reduce appetite, and lower blood sugar. Dual-class agonists, such as Lilly’s Zepbound (chemically, tirzepatide), combine agonist activity to produce a better effect by working synergistically in the brain and gut.

Some of the other modalities used by currently marketed drugs and those in development are:

- Lipase inhibitors (block fat-digesting enzymes in the gut)

- Appetite suppressants (target specific genes/receptors for hunger)

- Hormone/analog-based agents (slow gastric emptying)

- Genetic/receptor-targeted therapies (used for rare forms of obesity; work by regulating via the central nervous system)

Wave Sciences’s WVE-007 uses RNA interference (RNAi) to silence the INHBE gene, thereby reducing Activin E protein levels and promoting fat burning.

Lily Soars, Novo Lags

Novo Nordisk may have revolutionized the obesity drug race with its semaglutide diabetes drug, which was marketed as Ozempic. Initially, Ozempic was used off-label for weight loss before the Danish company gained regulatory approval for a higher dose of semaglutide, under the brand name Wegovy, exclusively for treating obesity.

The company has further beefed up the portfolio with Saxenda, an injectable formulation used in adults and some adolescents.

Novo Nordisk has also filed for regulatory approval for an oral formulation of its obesity drug and a long-acting GLP-1 analogue intended as a once-weekly treatment for obesity. The company also has several other candidates in various stages of development, including its next-generation drug candidate CargiSema.

The weight loss credentials of CargiSema, gleaned from two late-stage trial results, haven’t lived up to the hype, serving as a drag on the stock. The company has, however, maintained that it is on track to file a regulatory submission in the first quarter of 2026.

Rival Lilly’s has an FDA-approved obesity treatment, Zepbound, and its diabetes drug Mounjaro is also used to treat obesity. The company’s obesity pipeline is brimming with activity, including:

- Once-daily, oral GLP-1 receptor agonist Orforglipron (Phase 3 development)

- Triple-acting injectable incretin called Retatrutide (targeting GLP1+GIP and glucagon receptors)

- Once-weekly injectable late-stage candidate Eloralinitide

- Mid-stage Bimagrunab that came into its stable through its Versanis Bio buy (works by reducing fat mass even while preserving muscle mass)

Novo Nordisk’s weight-loss drug’s charm has since then declined. Citing lower growth for its GLP-1 treatment in diabetes and obesity, the company trimmed its 2025 forecast for the third time this year. To make matters worse, the company had to agree to a price cut for the direct-to-consumer sales in the U.S. to align with the Trump administration’s efforts to make drugs accessible and affordable.

The slowing sales of this money-spinning portfolio led to the ouster of Lars Fruergaard Jorgensen in May. The board explicitly stated that the exit was due to market challenges it faced and the resulting decline in the stock price since mid-2024.

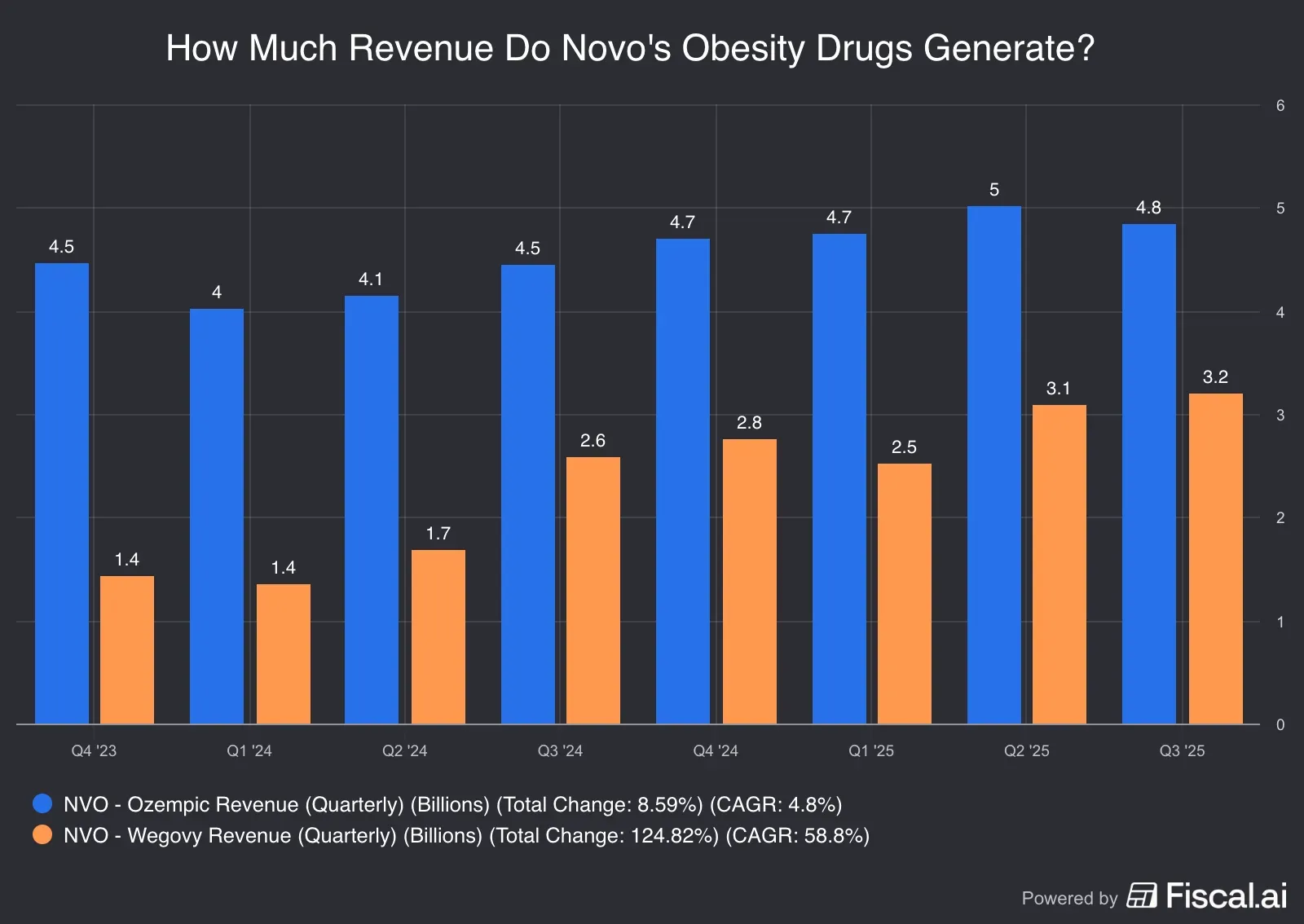

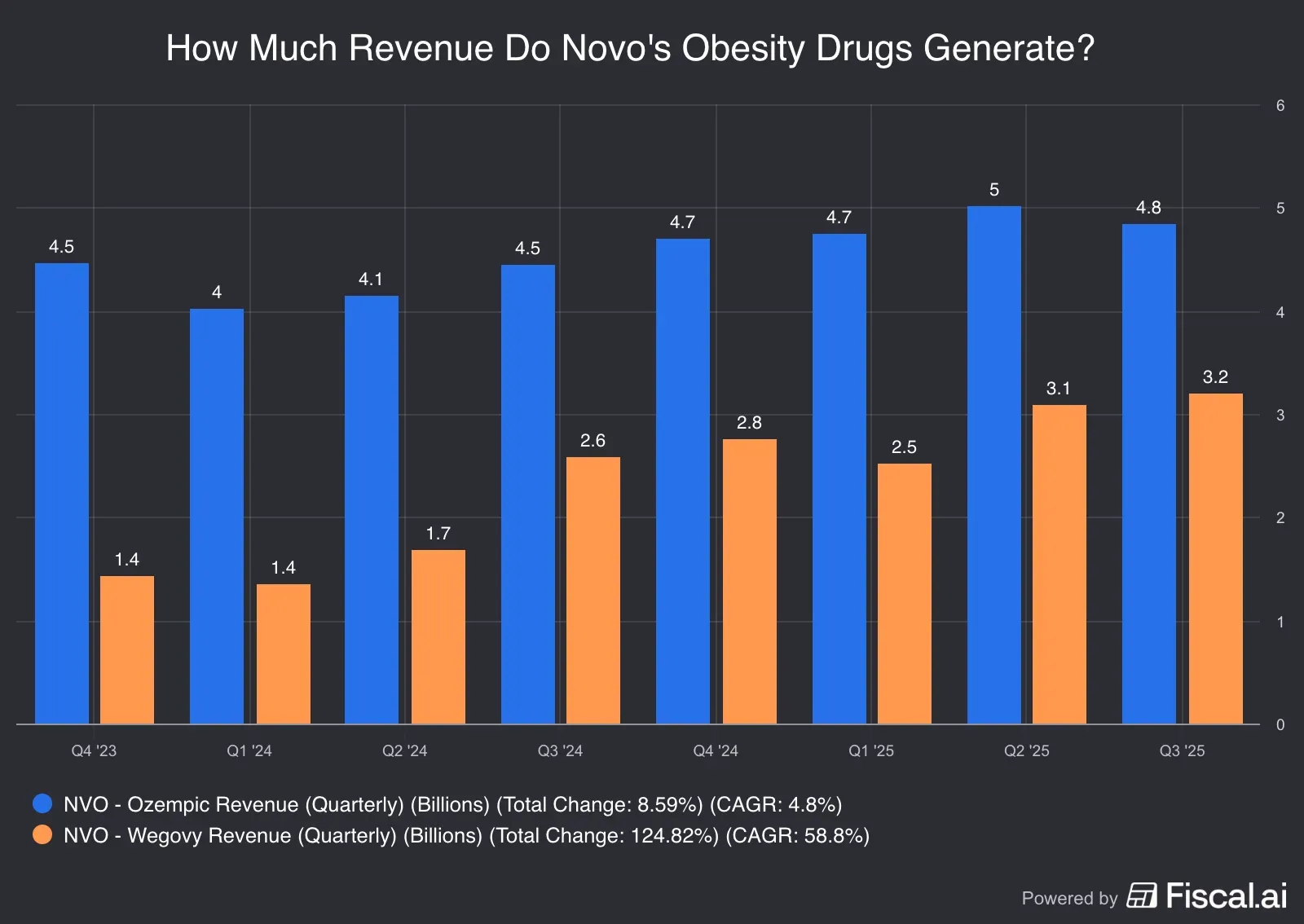

Here’s a look at how obesity portfolios of both companies have fared:

Source: Fiscal.ai

*Ozempic and Mounjaro sales may not be entirely attributable to the obesity indication since they are used off-label for the indication.

On Monday, JPMorgan slashed its price target for Novo Nordisk by 30% but maintained an ‘Overweight’ rating, the Fly reported. Argus downgraded the stock to ‘Hold’ from ‘Buy,’ citing the loss of share in the GLP-1 drug market and the price cuts in the U.S. The firm also flagged potential generic competition in some international markets and the lukewarm results from ongoing trials of pipeline candidates.

On the other hand, Eli Lilly stock received a price target hike from Guggenheim to $1163 from $1,036. The firm said the action followed the updation of its models for the two obesity drug rivals to reflect prescription trends, GLP-1 pricing updates, and announcements.

The stock prices of Lily and Novo Nordisk have captured the reversing fortunes of both companies.

Source: Koyfin

Source: Koyfin

Other Players Knocking On The Door

- Amgen - MariTide (Phase 3)

- Boehringer Ingelheim - Survodutide (Phase 3)

- AstraZeneca - AZD-6235, AZD-5004 (Phase 2)

- Arrowhead - ARO-ALK7 (Phase 2)

- Regeneron - Trevogrumab (Phase 2)

- Roche - RG-6640 (Phase 2)

- Pfizer - PR-07976016 (Phase 2)

- Viking - VK-2735 (Phase 2)

The Future

Drugmakers see the shift from injectables to oral formulations as the holy grail of obesity treatment. Lilly and Novo Nordisk both have an oral drug candidate in late-stage development. The latter could leave the worst behind and regain its lead if it can convince regulators of Cargisema's efficacy and safety.

Morgan Stanley sees the supply, additional clinical benefits for other diseases, expanded payer coverage, pill formulation and more efficient delivery mechanisms as factors that can increase the uptake of the obesity drugs.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_credo_technology_resized_cdb4311141.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228864541_jpg_d94770c5a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_joblessclaims_resized_jpg_b395b1ff15.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_cme_resized_5dbde36693.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Carvana_jpg_86121a5fd5.webp)