Advertisement|Remove ads.

Titan Shares: Growth Story Intact, But Premium Valuations Prompt Caution, Says SEBI RA

Titan shares slumped by more than 5% on Tuesday, despite reporting strong first-quarter updates, which showed a 20% growth in the consumer business and an 18% growth in the jewellery vertical. The company also opened 10 new stores during the quarter, bringing the retail network presence to 3,222 as of June 30.

Titan’s shares are down 5.4% at ₹3,461.1.

According to SEBI-registered analyst Vijay Kumar Gupta, Titan’s stock is overvalued, which could limit near-term upside. Despite this, the company’s long-term fundamentals remain strong.

The company’s financial health remains strong. In Q4, Titan reported a 19% increase in revenue and a 13% growth in profit after tax, driven by strong jewellery and watch segment performance.

Its return on equity (RoE) stands at 32%, and although the company maintains a low net debt, free cash flow turned negative in FY25 due to a rise in working capital.

The stock trades at 98 times earnings and 28 times book value, significantly above sector averages, with discounted cash flow (DCF) analysis suggesting overvaluation.

High gold prices continue to be a headwind, and while Titan outperforms peers like Kalyan Jewellers and Trent in terms of scale and profitability, its valuation remains equally elevated, the analyst said.

The stock has retreated from its 52-week high of ₹3,866 and is currently consolidating around the ₹3,470 level. Technically, it is finding key support between ₹3,200 and ₹3,400, with strong resistance close to ₹3,900.

Momentum indicators, such as the relative strength index (RSI) and moving average convergence/divergence (MACD), are showing neutral signals, Gupta said. Additionally, volume activity suggests a lack of aggressive buying, indicating a likely range-bound movement in the near term.

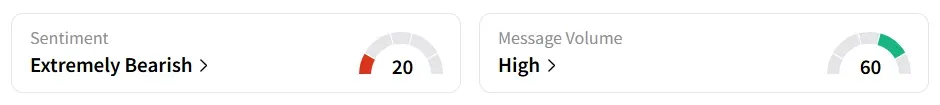

The stock price movement has led to apprehensions on Dalal Street, with retail sentiment on Stocktwits shifting from ‘neutral’ to ‘extremely bearish’ a week ago, amid high message volumes. It was also among the most trending stocks on the platform.

Year-to-date (YTD), the stock has gained 6.3%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1813801150_jpg_9e452258fa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2190302521_jpg_796f64970e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194612888_1_jpg_5f7b7f6186.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1384896168_jpg_87fab3f04d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263571605_jpg_f769289486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)