Advertisement|Remove ads.

Tesla Analyst Calls Massive Selloff A ‘Gut Check Moment’ For Bulls But Downplays Musk-DOGE Risks: Retail Traders Strongly Disagree

Tesla, Inc. shares finished Thursday over 5.6% lower and were on track for their seventh consecutive weekly loss, as falling sales and CEO Elon Musk spending more time in the Trump administration are causing investor anxiety.

However, the stock's biggest bull on Wall Street on Thursday reiterated its 'outperform' rating and 12-month price target of $550, which implies a more than doubling from the last close.

Wedbush analysts led by Dan Ives, in a note to clients, said bullish Tesla investors "find themselves with their back against the wall" as a result of the negative sentiment around Musk spearheading efforts to cut down wasteful federal spending as part of the Department of Government Efficiency (DOGE).

"This is a gut check moment for the Tesla bulls (including ourselves) after this massive selloff in Tesla shares, with fears mounting," the analysts said, noting recent lackluster sales data from Europe, China, and the U.S.

However, they recalled past instances of Tesla overcoming similar hurdles, such as "the white knuckle production moments in 2017/2018 to financing worries to the Musk/Twitter soap opera in 2022."

Wedbush said it received a flood of investor questions, including whether Musk's distractions could damage Tesla's brand loyalty and the company risks losing market share to rivals like BYD in China.

The analysts reiterated that the current period marks "the start of the biggest innovation and technology cycle in Tesla's history," driven by expectations of a lower-cost model, the launch of unsupervised full self-driving (FSD) in Texas by June, potential interest from other automakers in its self-driving technology, and the rollout of the 'Cybercab' robotaxi.

Wedbush admitted that Musk's alignment with DOGE and Trump has raised major brand worries for Tesla but estimates that less than 5% of the company's global sales are at risk due to these concerns.

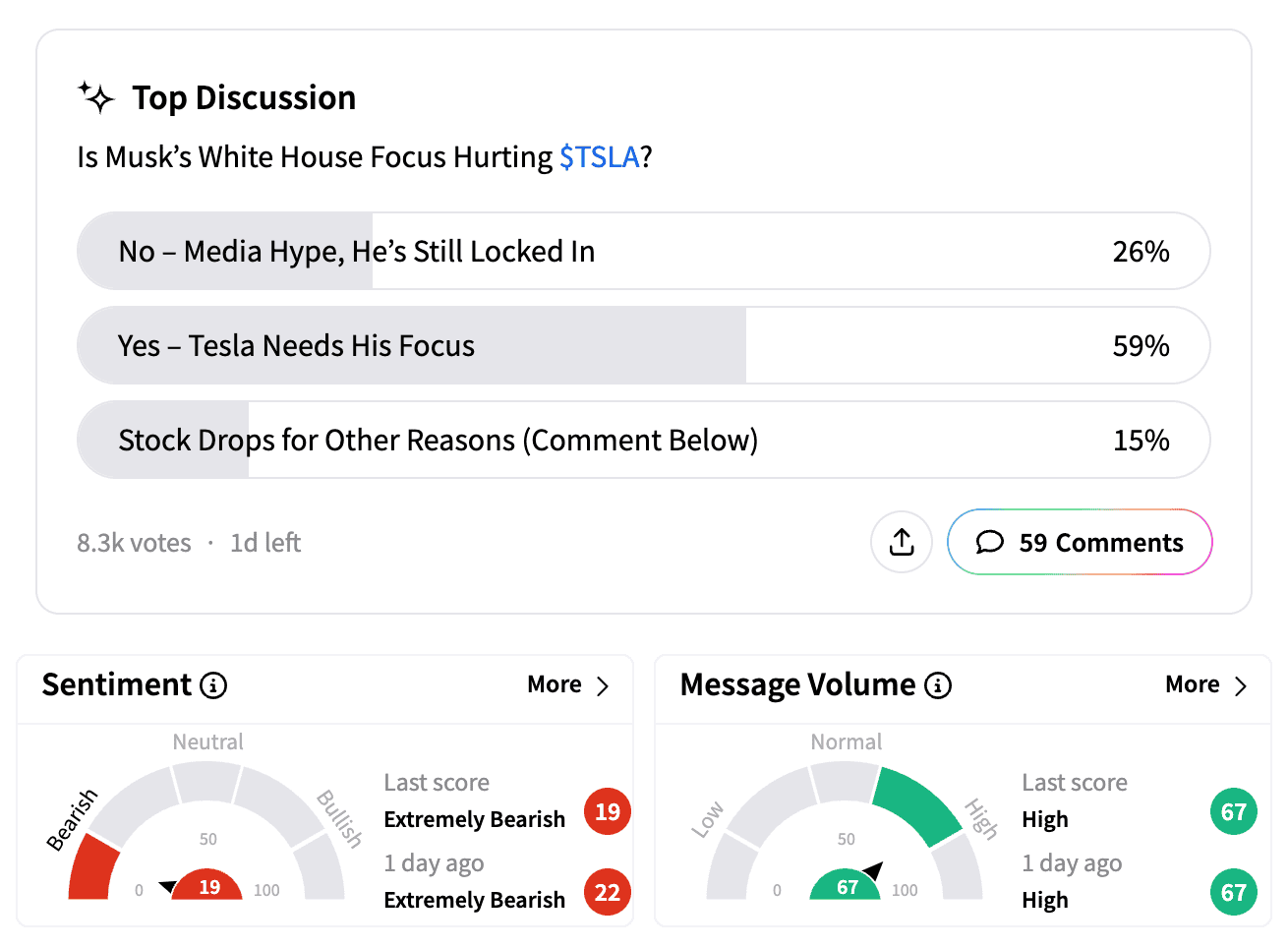

On Stocktwits, sentiment for Tesla has remained in the 'extremely bearish' zone for over a week amid a 15% drop in message volume over the past seven days.

One user sarcastically said that Tesla's market cap losses from Musk's focus on DOGE have outweighed any financial benefits DOGE has provided to U.S. taxpayers.

Another referenced Warren Buffett's famous quote about how "it takes 20 years to build a reputation and five minutes to ruin it", calling for Musk's ouster as Tesla CEO.

Tesla shares have fallen nearly a third since the start of 2025, wiping out over $350 billion in market value.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262712431_1_jpg_6f471d2542.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_490939e580.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1449195267_jpg_c8a3db2d5b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_coinbase_new_jul_2eaf8eb2ac.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ardelyx_jpg_488a3f8312.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)