Advertisement|Remove ads.

UBS Upgrades Caterpillar Stock On ‘Largely Derisked’ 2025, But Retail Stays Wary

Caterpillar, Inc. (CAT) shares drew significant retail investor attention on Monday after UBS upgraded the stock to ‘Neutral’ from ‘Sell’.

According to The Fly, UBS also raised the price target for the stock to $385 from $355, which implies a 3.7% upside from the stock’s last close.

The brokerage said that after two consecutive quarterly earnings before interest and taxes (EBIT) misses, expectations for Caterpillar have reset to lower.

UBS also said that Caterpillar's first half of 2025 is "largely de-risked," and there is potential for a return to double-digit earnings growth in 2026.

Last week, Caterpillar forecasted its 2025 sales to be below 2024 after missing estimates for fourth-quarter revenue. It expects unfavorable price realizations to reduce sales by 1%.

The company had attributed the decrease in quarterly sales volume to changes in dealer inventories and lower equipment sales to end users.

Caterpillar also said that it expects 2025 machinery inventories to remain essentially unchanged.

U.S. mortgage rates are rising steadily, tracking Treasury yields. A decline in new home constructions would hurt machinery suppliers such as Caterpillar.

Separately, Truist cut Caterpillar's price target to $438 from $455 but maintained a ‘Buy’ rating.

Caterpillar shares were down 1.8% at noon.

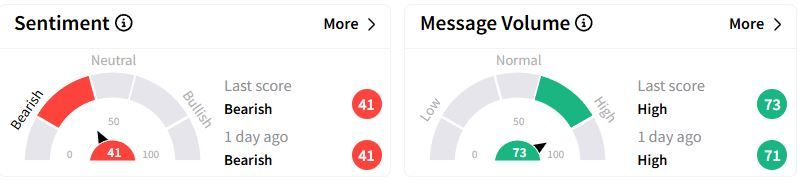

Retail sentiment on Stocktwits remained ‘bearish’ (41/100) territory, while retail chatter was ‘high.’

One user hoped the share buybacks could lift the stock.

Over the past year, the stock has gained 9.5%.

Also See: Triumph Group Stock Soars Premarket After $3B Buyout Deal With PE Firms: Retail’s Joyous

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2221559761_jpg_71120b5aaa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Core_Weave_jpg_861ba86dd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243050664_jpg_37b52748e2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_natural_gas_plant_resized_jpg_e43db2dc7b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)