Advertisement|Remove ads.

UnitedHealth Stock Slumps 20% Pre-Market On Downbeat Q1 Earnings, Gloomy Full-Year Forecasts: Retail Sentiment Dives

UnitedHealth Group (UNH) shares fell over 19% in pre-market trading on Thursday after the company lowered its annual earnings forecast on the assumption of higher costs.

The insurance company now sees full-year adjusted earnings per share (EPS) between $26 and $26.50, down from its previous forecast of $29.50 to $30, and below an analyst estimate of $29.74, as per FinChat data.

The company said that it expects an increase in costs from its Medicare Advantage businesses in 2025, higher than planned and consistent with the elevated levels in 2024. The number of people served by the company’s offerings for seniors and people with complex needs grew by 545,000 in the first quarter and is expected to grow to 800,000 in 2025, it added.

For the first quarter (Q1), UnitedHealth reported revenues of $109.6 billion, up from $99.8 billion in the corresponding quarter of 2024, but below an analyst estimate of $111.60 billion.

Adjusted EPS in the quarter came in at $7.20, up from $6.91 in the first quarter of 2024, but below an expected $7.29.

CEO Andrew Wity said that the company did not perform up to its expectations.

“...we are aggressively addressing those challenges to position us well for the years ahead, and return to our long-term earnings growth rate target of 13 to 16%,” he said.

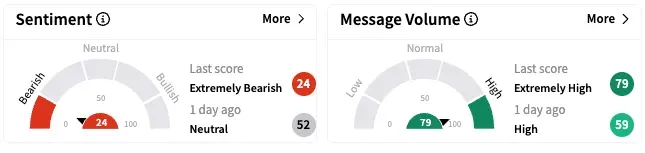

On Stocktwits, retail sentiment around UnitedHealth Group fell from ‘neutral’ to ‘extremely bearish’ over the past 24 hours while message volume jumped from ‘high’ to ‘extremely high’.

UNH stock rose by about 16% year-to-date and 22% over the past 12 months.

Also See: Equinor’s New York Offshore Wind Project Paused As Trump Administration Orders Further Review

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218096416_jpg_9d469a2ec6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019640_jpg_c6006d7238.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)