Advertisement|Remove ads.

UP Fintech Stock Surges Pre-Market On Upbeat Q4 Earnings, Revenue Jump: Retail Turns Exuberant

Shares of online brokerage UP Fintech Holding (TIGR) rose over 4% in Tuesday’s pre-market session after the company reported upbeat fourth-quarter earnings.

Total revenues rose 77.3% year over year (YoY) to $124.1 million during the quarter, beating a Street estimate of $73.6 million. Net income per ADS (diluted) stood at $0.158, compared to an analyst estimate of $0.11.

Net income attributable to ordinary shareholders came in at $28.1 million, compared to a net loss of $1.8 million in the same quarter last year.

During the quarter, the company added 59,200 customers with deposits, witnessing a 51.4% YoY rise in the metric. Asset inflows, too, remained robust, with a net inflow of $1.1 billion, primarily from retail investors.

The company’s total account balance rose by 2.4% quarter over quarter (QoQ) and 36.4% YoY to a record $41.7 billion.

UP Fintech saw its commissions rise 154.9% YoY to $56.0 million. Financing service fees fell 12.7% YoY to $2.8 million, driven by decreased securities lending activities.

Interest income jumped 39.6% to $55.8 million, driven by increased margin financing and securities lending activities of the firm’s consolidated account customers.

CEO Wu Tianhua highlighted that the firm underwrote 14 U.S. and Hong Kong IPOs, bringing the total number of U.S. and Hong Kong IPOs underwritten for the year to 44.

“In our ESOP business, we added 16 new clients in the fourth quarter, bringing the total number of ESOP clients served to 613 as of Dec. 31, 2024,” he said.

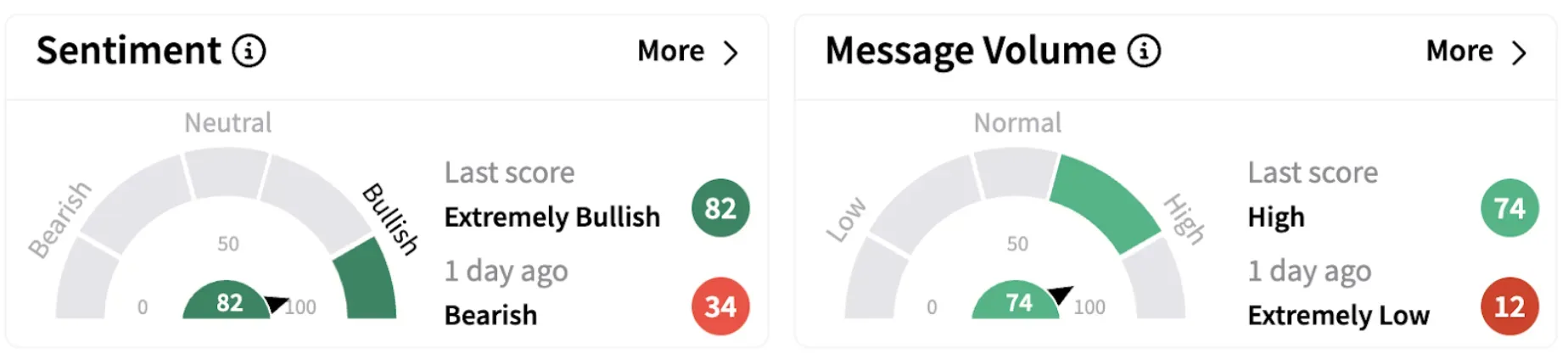

Meanwhile, on Stocktwits, retail sentiment flipped into the ‘extremely bullish’ territory (82/100) from ‘bearish’ a day ago. The move was accompanied by ‘high’ message volume.

Stocktwits users expressed optimism about the company’s earnings but had a mixed opinion regarding the stock reaction.

UP Fintech stock has gained over 19% in 2025 and over 77% in the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2207049226_jpg_7f1e685123.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tariffs_jpg_d7661eb31a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227347257_jpg_81c3539d3f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2204003106_jpg_405e036a7c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ondas_OG_jpg_05cf209e61.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_peter_tuchman_jpg_fb781e7355.webp)