Advertisement|Remove ads.

Upstart, Affirm Stocks Rise After Wedbush Upgrade: Retail Cheers The Move

Shares of AI-lending firm Upstart Holdings (UPST) soared over 15% on Monday to hit a 14-month high after Wedbush Securities upgraded the stock to ‘Neutral’ from ‘Underperform,’ with a price target of $45, up from $10.

The brokerage reportedly noted that improving credit quality metrics and lower interest rates could drive a positive inflection in originations and adjusted earnings before interest, tax, depreciation, and amortization (EBITDA) in the second half of 2024.

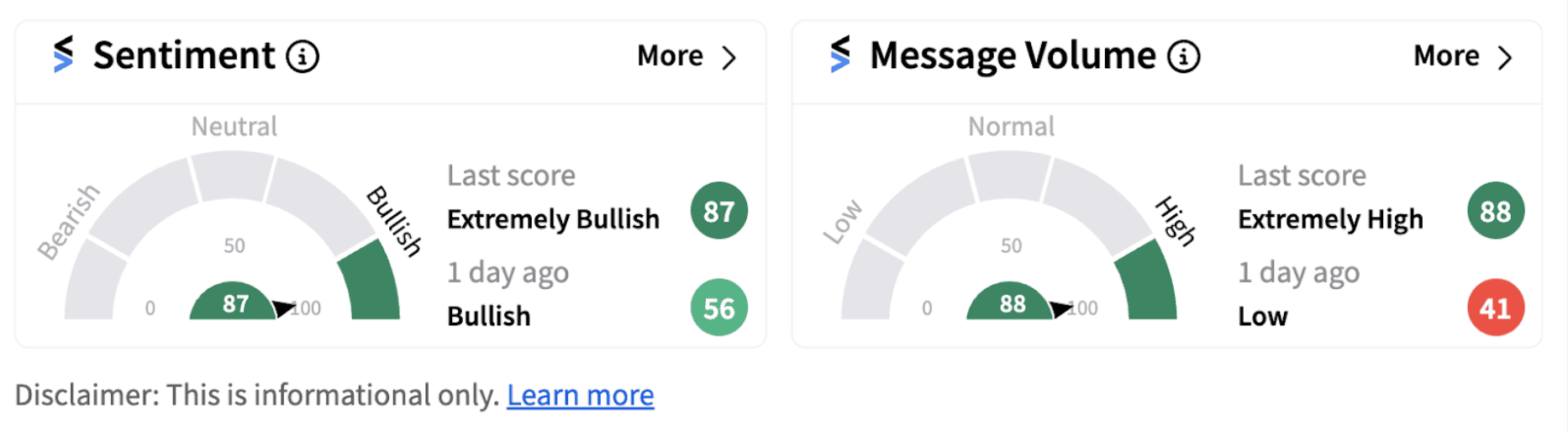

Wedbush reportedly expects a balanced risk/reward for the stock at current levels. Following the development, retail sentiment on Stocktwits shifted into the ‘extremely bullish’ territory from the ‘bullish’ zone, accompanied by ‘extremely high’ message volume.

Stocktwits users with a bullish outlook on the stock expect it to rally in the near term.

Meanwhile, shares of fintech company Affirm Holdings (AFRM) rose over 3% on Monday after Wedbush upgraded the stock to ‘Neutral’ from ‘Underperform,’ with a price target of $45.

Wedbush reportedly noted that a lower interest rate environment should be beneficial to the frim on multiple fronts like lower funding costs and incremental gross merchandise volume (GMV) growth.

The brokerage reportedly stated that credit quality has consistently outperformed the company’s expectations over the past years in a higher interest rate environment partly due to the short duration of the firm’s product. The brokerage also expects strong credit quality to continue, at least in the short term.

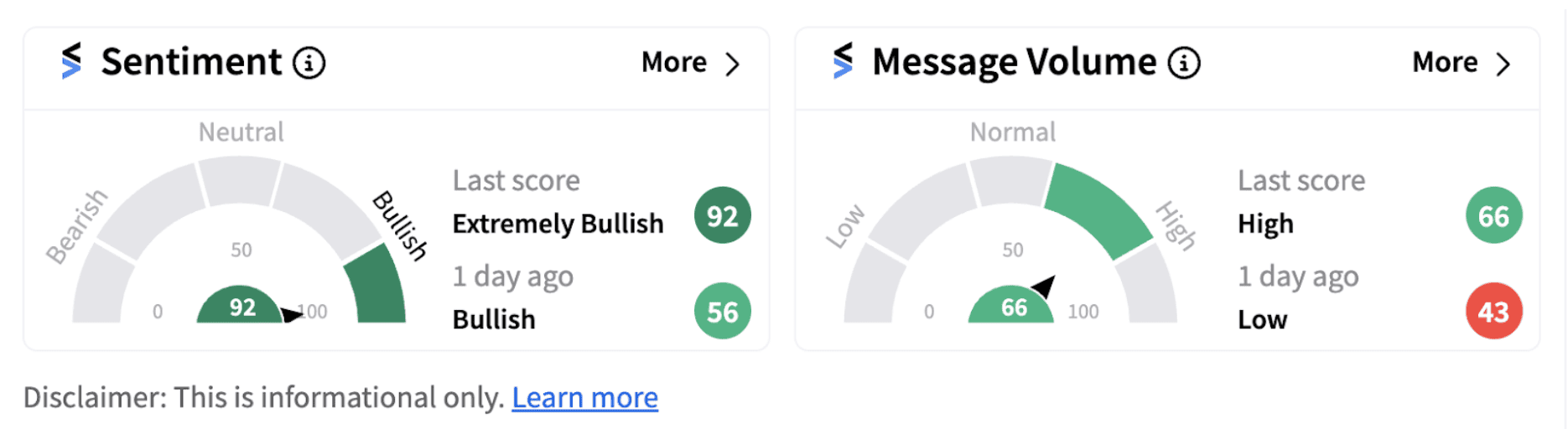

Following the development, retail sentiment on Stocktwits jumped into the ‘extremely bullish’ territory (92/100) from ‘bullish’ a day ago, accompanied by high retail chatter.

One Stocktwits user expects the shares to touch the $50 mark very soon.

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_lumen_technologies_logo_resized_jpg_29f9980341.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_circle_logo_original_jpg_93ebf851f7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2212184506_jpg_fda8936683.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Novo_Nordisk_jpg_96dd19f953.webp)