Advertisement|Remove ads.

US Reportedly Weighs Revoking Chip Waivers For China-Bound Tech Exports

U.S. Commerce Department officials are reportedly considering ending waivers that allow major global chipmakers to export American semiconductor equipment to factories in China.

A Wall Street Journal report said a senior Commerce official met recently with companies such as Samsung Electronics and Taiwan Semiconductor Manufacturing Co. (TSM) to discuss rescinding blanket permissions that have let them ship U.S.-made chip tools to China without applying for licenses on a case-by-case basis.

If enacted, the repeal could exacerbate U.S.–China trade tensions and strain ties with South Korea and Taiwan.

Affected firms would need to secure individual export permits and may turn to Japanese and European tool suppliers instead.

The report indicated the measure would mirror China's licensing regime for rare earth magnets, aiming to establish parity in trade controls.

The move also fits into President Donald Trump’s broader effort to curb China’s access to advanced technology even amid a tentative trade truce struck in London earlier this month.

In the past few months, the U.S. government has stopped shipments of advanced semiconductors from Nvidia and Advanced Micro Devices to China, resulting in multi-billion-dollar losses for the American firms.

Nvidia was hit with an export restriction on its H20 products to China starting April 9. The company reported a $4.5 billion first-quarter charge linked to surplus H20 inventory and supply commitments.

Samsung’s Xi’an memory-chip plant and TSMC’s Chinese fabs, which serve global markets in memory, logic, and AI, may experience rising costs and operational hurdles.

Removing waivers may prompt Taiwan and South Korea to seek U.S. diplomatic help. It also comes as both countries negotiate new trade deals with Washington.

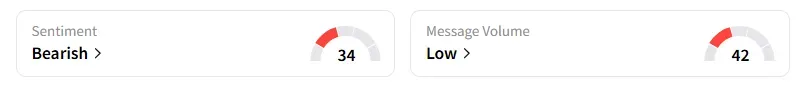

On Stocktwits, retail sentiment around Taiwan Semiconductor remained in ‘bearish’ territory.

Pro-national security advocates, including Jeffrey Kessler, who leads the Commerce Department’s export control division, have pushed for strict limits on U.S. technology exports to China, believing tough actions are essential to curb Beijing’s progress in key industries and encourage alternative supply chains.

Also See: UK Regulator Investigates Amazon Over Supplier Payment Practices, Retail Stays Wary

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2246580703_jpg_9700e1e7e8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2189643067_jpg_243b1172b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1494564204_jpg_be6f667516.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259256580_jpg_e72ea8ddc5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_supermicro_resized_jpg_95d12828d5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_UWM_resized_f22f7e06b8.jpg)