Advertisement|Remove ads.

US Steel Retail Traders Extremely Bullish After Trump Approves Nippon Bid: Analysts Weigh In

U.S. Steel (X) stock continued to garner retail attention after President Donald Trump said on Sunday that the company would remain under the control of the United States as part of its partnership with Japan’s Nippon Steel.

After months of deliberations, Trump indicated his backing for Nippon Steel’s $14.9 billion bid for U.S. Steel on Friday. He said the partnership would create 70,000 jobs and add $14 billion to the U.S. economy.

"It will be controlled by the United States. Otherwise, I wouldn't make the deal," Trump said to reporters, according to Reuters, after being asked about the agreement's details.

The deal was a sensitive point for Pennsylvania legislators with thousands of jobs at stake in the critical swing state that voted for Trump in the 2024 elections.

"It's an investment and it's a partial ownership, but it will be controlled by the USA," he said after reportedly being pressured by relevant lawmakers.

Reuters and other outlets reported that Nippon Steel was also planning to build a new steel mill for $4 billion as part of its investment package for the Pittsburgh-based company.

According to TheFly, Morgan Stanley analysts expected U.S. Steel shares to move towards its bull case of $55, the acquisition price Nippon Steel is expected to pay.

The brokerage also anticipates peers Cleveland-Cliffs (CLF), Steel Dynamics (STLD), and Nucor (NUE) shares to underperform due to the inclusion of a large global competitor in the U.S. steel market. The merger is expected to create the third-largest steelmaker in the world by volume.

Jefferies downgraded the stock to ‘Hold’ from ‘Buy’, TheFly reported. The brokerage said the 21% jump in U.S. Steel shares on Friday indicated that the market believes a complete takeover with $55 per share is likely.

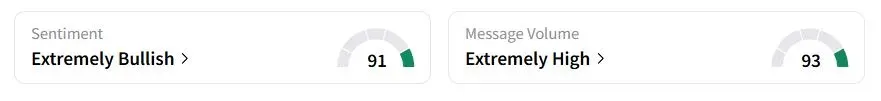

Retail sentiment on Stocktwits jumped to ‘extremely bullish’ (91/100), while retail chatter remained ‘extremely high.’

One optimistic trader hoped the stock would go above $55. Further details about the partnership have yet to be reported.

“Partnership likely means US Steel will remain an independently traded company. A percentage of profits will flow to Nippon,” one retail trader said.

Some traders, however, cautioned that the stock could still slip.

Trump is expected to address a rally on May 30 in Pittsburgh about the merger.

U.S. Steel stock has gained 52% year to date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2237441231_jpg_b3b4b09b87.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_blue_owl_capital_jpg_4d9954c2ac.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227553061_jpg_699278f844.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_trump_media_and_technology_group_media_009b60f8cd.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_HP_corporate_logo_resized_a2479d3136.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_terawulf_OG_jpg_a87a18705d.webp)