Advertisement|Remove ads.

Valero Energy Stock Rises Pre-Market After Upbeat Q3 Print: Retail Ignores Big Profit Decline

Shares of refiner Valero Energy Corporation ($VLO) rose nearly 1% in Thursday’s premarket session after the firm’s third-quarter (Q3) earnings and revenue topped Wall Street estimates.

The firm reported a 14% year-over-year (YoY) decline in its Q3 revenues to $32.87 billion compared to a Wall Street estimate of $31.13 billion. Adjusted earnings per share (EPS) came in at $1.14 versus an estimate of $0.98. Net income, however, slid over 86% YoY to $364 million during the quarter.

Refining margins came in at $2.41 billion during the quarter compared to $5.41 billion in the same quarter a year ago.

The firm’s refining segment reported Q3 operating income of $565 million, compared to $3.4 billion for the same period a year ago.

The Renewable Diesel segment reported $35 million of operating income compared to $123 million for the third quarter of 2023. Meanwhile, the Ethanol segment saw $153 million of operating income versus $197 million for the third quarter of 2023.

The company returned $907 million to stockholders in Q3, of which $342 million was paid as dividends while $565 million was used for the purchase of approximately 3.8 million shares of common stock.

As of the end of the third quarter, the company has $8.4 billion of total debt, $2.5 billion of finance lease obligations, and $5.2 billion of cash and cash equivalents.

Valero highlighted that its SAF project at the DGD Port Arthur plant was completed in October and is expected to be fully operational this year.

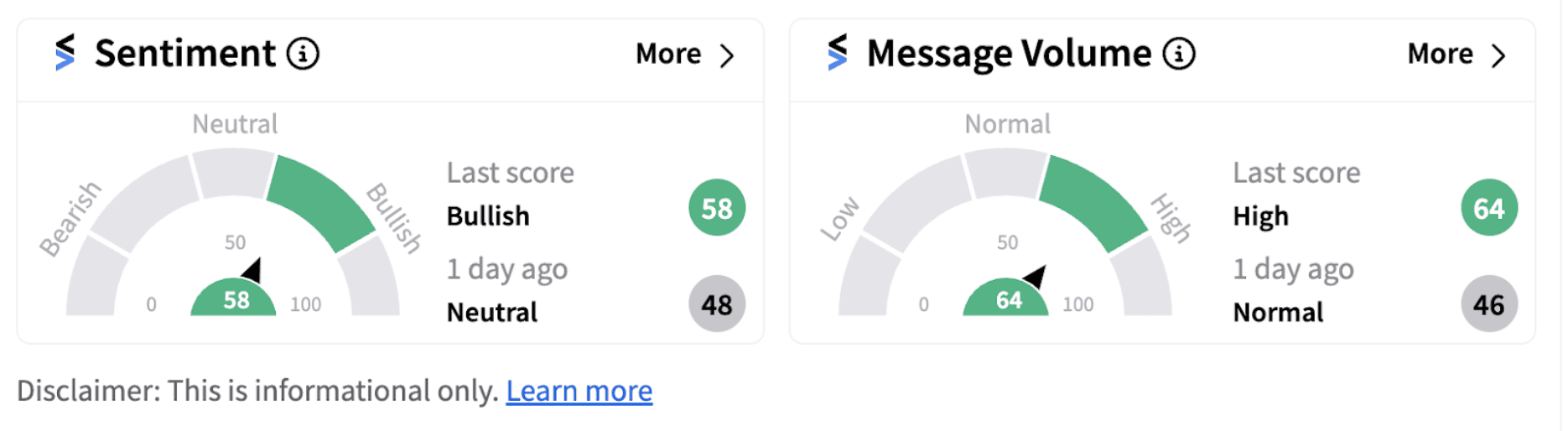

Following the earnings release, retail sentiment on Stocktwits inched up into the ‘bullish’ territory (58/100), supported by high retail chatter.

Shares of Valero Energy have gained just about 1.7% this year so far.

Also See: Keurig Dr Pepper To Acquire Energy Drink-Maker Ghost For Nearly $1B: Retail Sentiment Inches Higher

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)