Advertisement|Remove ads.

Vistra Edges Higher After $1.9B Natgas Asset Acquisition Deal, Sparks Early Bullish Chatter

Vistra (VST) stock rose 3.3% in extended trading on Thursday after the company agreed to buy natural gas generation assets from private equity firm Lotus Infrastructure Partners for $1.9 billion.

The utility firm said the assets have a total generation capacity of 2,600 megawatts and are located across New England, New York, California, and the PJM interconnection, which provides electricity to 13 U.S. states, including Delaware, Illinois, Indiana, Kentucky, and Pennsylvania.

“The addition of this attractive portfolio of combined cycle and peaking assets allows Vistra to serve growing power demand while exceeding our mid-teens levered return target,” CEO Jim Burke said.

Vistra expects to fund the transaction using an existing term loan from Lotus and cash on hand.

According to Energy Information Administration data, U.S. power consumption would continue to hit fresh records in 2025 and 2026.

Much of the growth is attributable to data centers as tech giants such as Microsoft and Google pledge billions of dollars to set up new data centers.

The company said the deal, expected to close in late 2025 or early 2026, would be immediately accretive to its share price.

It also reiterated its planned spending of $300 million in annual dividends and at least $1 billion in share repurchases yearly.

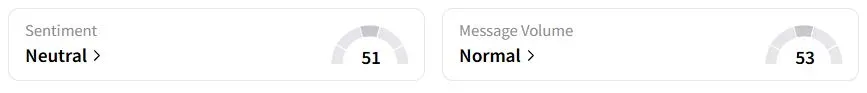

Retail sentiment on Stocktwits was in the ‘neutral’ (51/100) territory, while retail chatter was ‘normal.’

One retail trader said the stock is “flying to the 200s.”

Another user wondered if the stock could rally like its peer, NRG Energy, did following its acquisition of energy assets earlier this month.

Vistra stock has gained 8.9% year to date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2190302521_jpg_796f64970e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194612888_1_jpg_5f7b7f6186.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1384896168_jpg_87fab3f04d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263571605_jpg_f769289486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263454468_jpg_23f4595a31.webp)