Advertisement|Remove ads.

Vistra Stock Falls Despite Q4 Earnings Beat – Retail Blames Nvidia’s Drop

Vistra Corp. (VST) shares fell nearly 9% in morning trading Thursday, retreating from earlier gains as investors processed the company’s fourth-quarter results and reaffirmed full-year guidance.

The pullback coincided with a 3.5% decline in Nvidia (NVDA) shares to around $126 after the AI bellwether posted an earnings beat but also warned that gross profit margins would be tighter than anticipated as it rolls out its new Blackwell chip design.

The two industries have moved in tandem in recent weeks, with nuclear stocks reacting to shifts in demand expectations for energy-intensive AI infrastructure.

Last week, nuclear stocks declined after TD Cowen analysts reported that Microsoft had canceled some data center leases in the U.S., raising concerns about softer-than-anticipated power demand.

Vistra posted fourth-quarter earnings per share of $2.38, exceeding Wall Street’s consensus estimate of $2.22. Revenue reached $4.04 billion, ahead of the expected $3.91 billion, according to Koyfin data.

The company reported a net income of $490 million for the quarter, a sharp turnaround from a loss of $184 million in the prior year. Adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) reached $1.93 billion, surpassing FactSet’s consensus forecast of $1.38 billion.

Vistra reaffirmed its 2025 guidance, projecting adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) from ongoing operations between $5.5 billion and $6.1 billion. The company also expects adjusted free cash flow before growth investments to range between $3 billion and $3.6 billion.

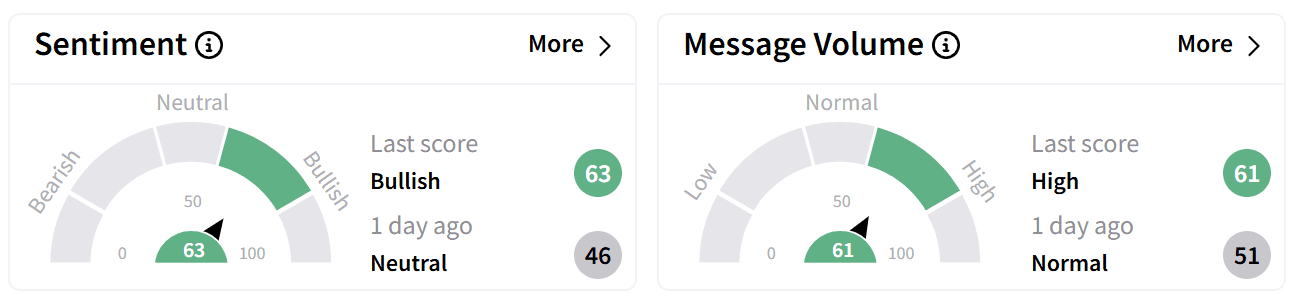

Retail sentiment on Stocktwits shifted to ‘bullish’ from ‘neutral’ the day before, with chatter volume rising to ‘high’ levels.

Some users pointed to Nvidia’s decline as a key factor in Vistra’s stock movement.

One user asserted the aptness of the day to take a long position.

Notably, jobs data showed a spike in unemployment claims to the highest level in five months.

Despite Thursday’s drop, Vistra shares remain up 182% over the past year and have lost 1.5% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read also: Nvidia’s Streak of Record-Breaking Quarters Drives Retail To Buy More And Stay Long

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229918735_jpg_e905cbd5e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250240977_jpg_5b777d96ef.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2206295220_jpg_1057588802.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247614893_jpg_e1dcf2d2f6.webp)