Advertisement|Remove ads.

Wall Street Downgrades Intel, Morgan Stanley, Intercontinental Exchange: Does Retail Agree?

Major U.S. indices declined nearly 2% on Friday, with Wall Street analysts injecting some bearishness into Intel, Morgan Stanley and Intercontinental Exchange. While Intel’s forecasts and massive jobs cuts disappointed everyone, Stocktwits users are at odds with Wells Fargo’s downgrade of Morgan Stanley. Here’s a look at what investors think about Friday’s analyst actions.

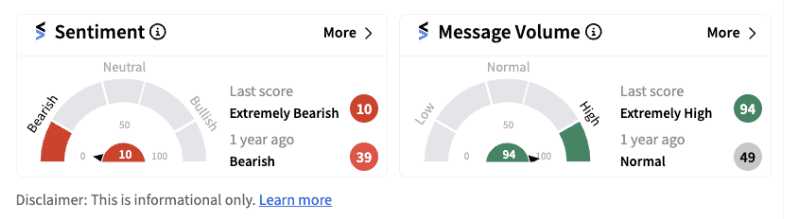

1. Intel: Bank of America reportedly downgraded Intel to ‘Underperform' from ‘Neutral’ while reducing the price target to $23 from $35. The downgrade comes on the back of Intel significantly reducing its forecasts following its weak second-quarter results and third-quarter outlook. The huge miss came in the form of EPS that stood at $0.02 versus an estimate of $0.10. On Friday, shares of the chip-maker plunged over 27% as it announced plans to cut 15% of its workforce as part of its $10-billion cost-reduction plan. Retail sentiment on the stock flipped into the ‘extremely bearish’ territory (10/100) from the bullish zone, supported by huge message volumes.

2. Morgan Stanley: Wells Fargo reportedly downgraded Morgan Stanley to ‘Underweight’ from ‘Equal Weight’ while reducing the price target to $95 from $99. Wells Fargo analyst believes Morgan Stanley has the highest valuation of any large cap bank. The valuation premium comes despite slowing wealth flows, downward pressure on net interest income and fee realization, among other factors, the firm indicated. Morgan Stanley had topped analyst estimates on revenue and earnings during the second quarter and its investment banking revenue surged over 50%. Retail investors turned ‘bullish’ (51/100) on the stock from being neutral a day ago.

3. Intercontinental Exchange: Deutsche Bank reportedly downgraded Intercontinental Exchange to ‘Hold’ from ‘Buy’ and trimmed the price target to $152, down from $155. Deutsche Bank believes the stock is fairly valued at the current price target. The NYSE-parent topped second-quarter analyst estimates, having delivered earnings per share of $1.52 versus

an estimate of $1.49. Retail investors, however, have turned sour on the stock with the sentiment dipping into the ‘extremely bearish’ territory (24/100) from the bearish zone.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_novavax_vaccine_resized_455cef63e9.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_Bessent_jpg_46300c35ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247652849_jpg_677ca89c63.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_tariffs_988fe70bab.webp)