Advertisement|Remove ads.

Wall Street Expects GM Revenue, Earnings To Fall In Q2, But Retail Investors Find No Reason To Be Pessimistic

Wall Street analysts, on average, expect automaker General Motors (GM) to report a year-over-year decline in second-quarter earnings and revenue.

GM will release its second-quarter 2025 financial results on Tuesday, before the bell.

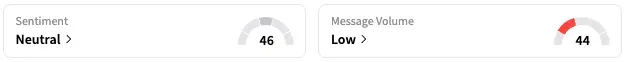

On Stocktwits, retail sentiment around GM rose from ‘bearish’ to ‘neutral’ territory over the past 24 hours while message volume remained at ‘low’ levels. The stock traded 1% higher at the time of writing.

According to data from Fiscal AI, GM is expected to report earnings per share of $2.53 for the three months through the end of June, down from the $3.06 reported in the corresponding quarter of 2024 and below the $2.78 reported in the first quarter of 2025.

Revenue is expected to be $45.95 billion, down from the $47.97 reported in the second quarter of last year.

However, JPMorgan analyst Ryan Brinkman raised the firm's price target on General Motors to $60 from $56, while keeping an ‘Overweight’ rating on the shares.

The firm increased automaker estimates ahead of the Q2 reports to reflect "better-than-feared" production as consumers bought vehicles ahead of anticipated tariff-related price increases.

Benchmark analyst Mickey Legg also initiated coverage of General Motors with a ‘Buy’ rating and $65 price target, calling the stock "a compelling opportunity for investors seeking exposure to a durable, cash-generative U.S. industrial franchise with underappreciated upside potential."

GM's core business remains resilient, and the company is executing well on its transformation roadmap while maintaining a balanced approach to shareholder returns and growth, the analyst argued.

Earlier this month, GM announced that its U.S. sales increased 7% in the second quarter to 746,588 units, thanks to a rise in sales of its crossovers.

“The industry sales pace is normalizing after stronger-than-expected industry sales in April and May,” GM then said while adding that the total vehicle SAAR (seasonally adjusted annual rate) was approximately 16.5 million in the second quarter and 16.8 million in the first half.

The company also stated that, together with its joint venture, it achieved the largest quarterly sales surge in four years in Q2 in China. Q2 deliveries exceeded 447,000 units in China, marking GM’s second consecutive quarter of year-over-year sales growth in China with a 20% increase.

GM stock is trading flat this year and has gained over 8% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2195701587_jpg_dde6526b92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_core_scientific_coreweave_OG_jpg_58f1ea2dbf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2255969940_jpg_0903b745a1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218181288_jpg_d22b8a81ff.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ryanair_michael_oleary_jpg_d2a378f59e.webp)