Advertisement. Remove ads.

Walmart Earnings: Stocktwits Investors Celebrate Retail Giant’s Upbeat Earnings, Improved Outlook

Walmart on Thursday reported upbeat financial results, with earnings and revenue beating Wall Street estimates, while also raising its full-year guidance, sending its stock up over 8% before the opening bell.

Second-quarter revenue rose 4.7% year-over-year (YoY) to $169.34 billion versus an estimate of $167.38 billion while earnings came in at $0.67 compared to an estimate of $0.65. Net income, however, declined 43% YoY to $4.5 billion.

The company now expects its full-year net sales to increase 3.75% to 4.75% compared to the marginal increase over the 3% to 4% rise stated earlier. Adjusted operating income is expected to increase 6.50% to 8.00%. Earlier, Walmart had projected the growth rate to inch toward the high-end or slightly over the original guidance increase of 4.00% to 6.00%.

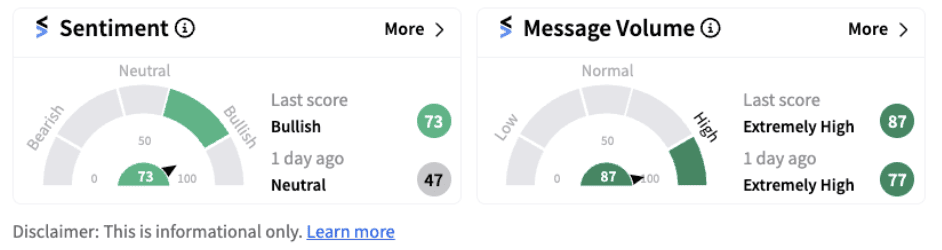

Retail sentiment on Stocktwits jumped to the ‘bullish’ territory (73/100) from the ‘neutral’ territory a day ago.

From a segmental standpoint, Walmart U.S. witnessed a 4.1% growth in its net sales to $115.30 billion, reflecting strength in transaction counts and unit volumes, across both stores and e-commerce channels. The company saw strong momentum in e-commerce with growth of 22%, led by store-fulfilled pickup and delivery.

Walmart International saw net sales rise 7.1% to $29.6 billion while e-commerce sales grew 18%, led by store fulfilled pick-up and delivery and marketplace.

Sam’s Club saw a 4.7% rise in net sales to $22.9 billion, led by food and health & wellness as well as increases in transactions and unit volumes.

For the third quarter, the firm expects a 3.25% to 4.25% rise in consolidated net sales along with a 3.00% to 4.50% rise in operating income.

Chief Financial Officer John David Rainey told CNBC that the firm’s brighter outlook reflects strength in the first half of the year. “We see, among our members and customers, that they remain choiceful, discerning, value-seeking, focusing on things like essentials rather than discretionary items, but importantly, we don’t see any additional fraying of consumer health,” Rainey stated.

Although some Stocktwits users are wary about the state of the economy limiting the firm’s growth, bulls remain optimistic about the company’s improved guidance for the full year.

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_price_rising_OG_jpg_5f141f956f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Apple_i_Phone_17_jpg_f5d6f375c2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_apple_iphone_17_jpg_81dde6287d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/08/2016-02-24t120000z-341190126-gf10000320991-rtrmadp-3-thailand-business-2025-08-30fd086ee671eeb1054eae7ad98cc01e.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_obesity_resized_jpg_cbb4f6b5e4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_jpg_9c9db98ee3.webp)